Today the BIS Committee on Payments and Market Infrastructures (CPMI) opened a consultation on increasing the adoption of payment versus payment (PvP) in foreign exchange (FX) transactions. In other words, ensuring that both currencies are exchanged simultaneously to reduce risk. In the DLT world, it’s referred to as atomic settlement.

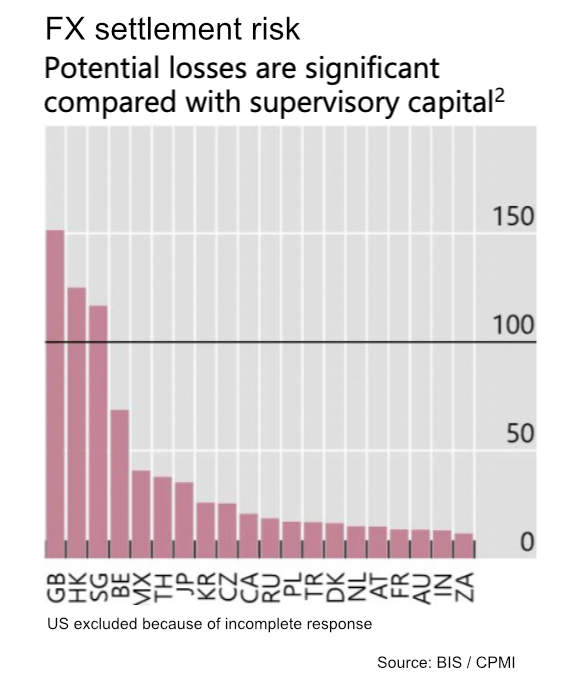

In terms of total risk exposure, the FX market is the largest. Daily turnover was $6.6 trillion in 2019. A recent survey found that on any given day, $8.9 trillion may be at risk, with a potential loss of up to $2.8 trillion. In some jurisdictions, bank exposures to FX risks are bigger than their supervisory capital.

The UK is the country with the biggest exposure: FX risks are 150% compared to bank capital. Hong Kong and Singapore are also above 100%.

That’s why the CPMI considers the issue a threat to global financial stability.

Between 2006 and 2019, the proportion of forex transactions that settled with PvP protection declined from 50% to less than 40%. The reason for the decline is the rise of emerging market economies (EMEs), and many EME currencies don’t have PvP available. In some cases, for currency pairs where PvP is available, one party may not be able to access it. For example, in Hong Kong, PvP for the USD to Renminbi pair is only open to certain banks in Hong Kong, Indonesia, Malaysia and Thailand.

Other reasons for low adoption include operating hours and high transaction costs.

DLT dominates FX PvP proposals

The CPMI previously requested novel ideas to address the issue. It received 16 responses and explores ten concrete solutions. Five of them are decentralized and four out of the five use DLT. Additionally, another proposal from Citi was conceptual: the Regulated Liability Network.

Of the ten concrete proposed solutions, only one is live: Baton Systems’ Core FX DLT, which underpins HSBC’s FX Everywhere offering, also used by Wells Fargo. It has processed several trillion dollars in trades.

The other DLT solutions are 9th Gear, Fnality, and Project Jura.

9th Gear aims to split intraday lending from the FX trade to engage new lenders. It enables PvP settlement.

Fnality is owned by 16 global financial institutions. It uses a Sterling omnibus central bank account to tokenize money, enabling blockchain-based payments. With GBP launching in October, it plans to add support for USD, EUR, CAD and JPY, subject to central bank approval.

Project Jura is a wholesale central bank digital currency (wCBDC) solution from the Swiss National Bank, the Banque de France and the BIS Innovation Hub.

The CPMI was keen to emphasize it doesn’t endorse any of the solutions.

The consultation is open until September 30, 2022.