Yesterday Swift released the results of its second phase of simulated trials exploring how to interconnect central bank digital currency (CBDC) systems across multiple jurisdictions. Thirty-eight institutions participated, including more than seven central banks. Reuters reported that Swift plans to launch the solution in 12-24 months.

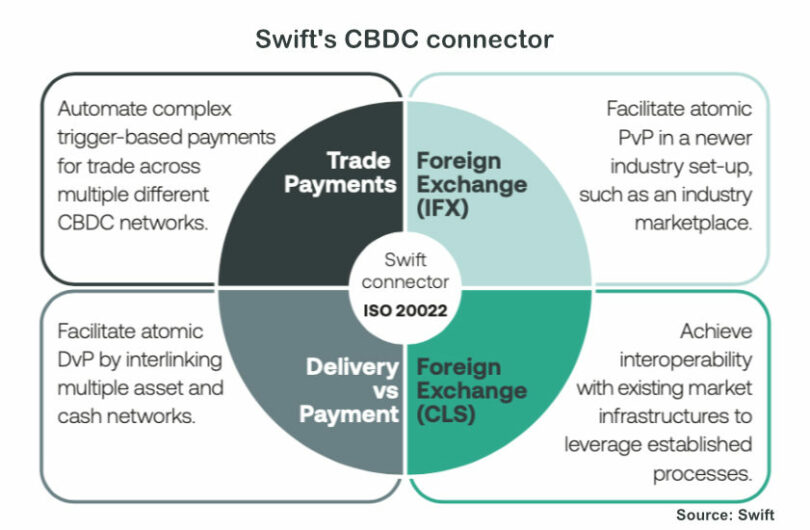

For the latest tests it explored four advanced uses cases:

“Interoperability between DLT networks is an important piece of the puzzle to enable efficient connectivity between CBDC and other networks and to avoid silos,” said Sabih Behzad, Head of Digital Assets & Currencies Transformation at Deutsche Bank. “Testing Swift’s solution for different use cases such as DvP and FX with 38 commercial and central banks is a significant step to overcoming fragmentation and ensuring frictionless transactions.”

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.