Yesterday Swift released the results of its second phase of simulated trials exploring how to interconnect central bank digital currency (CBDC) systems across multiple jurisdictions. Thirty-eight institutions participated, including more than seven central banks. Reuters reported that Swift plans to launch the solution in 12-24 months.

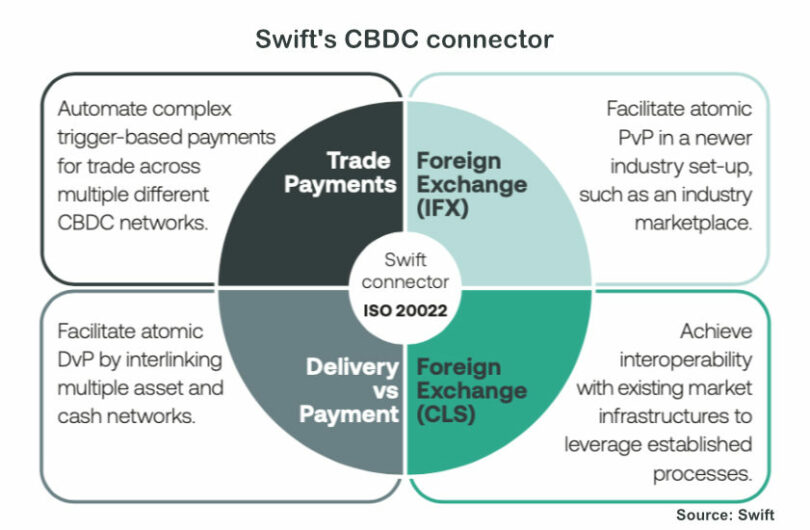

For the latest tests it explored four advanced uses cases:

- trade payments

- foreign exchange (FX) payment versus payment (PvP)

- delivery versus payment for securities and

- liquidity savings mechanisms (LSMs).

“Interoperability between DLT networks is an important piece of the puzzle to enable efficient connectivity between CBDC and other networks and to avoid silos,” said Sabih Behzad, Head of Digital Assets & Currencies Transformation at Deutsche Bank. “Testing Swift’s solution for different use cases such as DvP and FX with 38 commercial and central banks is a significant step to overcoming fragmentation and ensuring frictionless transactions.”

We’ve previously questioned the use of messaging in DLT environments. However, there are situations where it is necessary. Currently, there’s a proliferation of DLT-based networks, and they need to either be interoperable or at least communicate. Messaging is one way for that to happen. Secondly, existing payment systems work on messaging, so it is necessary to integrate the new with the old. What Swift is trying to do is create a single point of connection between all the different systems, both new and old.

Apart from its CBDC connector, Swift has been involved in multiple DLT initiatives, including DLT interoperability for tokenized securities and promoting electronic bills of lading (eBL). In many ways, the latest trial is an amalgamation of those initiatives.

CBDC connector use cases

Two foreign exchange experiments formed part of the latest tests – creating a tokenized foreign exchange (FX) marketplace and a CLS-inspired settlement solution. CLS is the FX netting and settlement solution that processes around $2 trillion in transactions daily. Employing tokens and distributed ledger technology (DLT) solutions allows for atomic settlements, meaning that, even without instantaneous settlement, both parts of the FX payment occur at the same time, thus mitigating counterparty risks.

It sounded like the simulated International Foreign Exchange Marketplace was very well received. It involved escrowing currency on a domestic CBDC network and issuing a wrapped token onto the FX marketplace, a separate network. Within the marketplace, swaps happen using smart contracts. Once the swap is finalized, the marketplace tokens are redeemed and the acquired foreign currency is available to its new owner on the domestic network. This enabled central banks visibility over their CBDC on a network (the marketplace) they don’t control.

All the use cases had positive outcomes. However, feedback showed that liquidity savings mechanisms are not a current priority for participants. That may seem surprising since each DLT network often traps liquidity. However, only a few have gained traction. Several reasons were given for deliberately fragmented liquidity. “These may include risk management, business continuity, customer preference and cost of payment,” the report notes.

Meanwhile, the trials involved three DLT technologies: Corda, Hyperledger Besu and Fabric. Kaleido was the tech solution provider and CapGemini was the integrator.

Swift has extensive future plans, including supporting more DLT technologies, expanding the use cases, and linking with tokenized deposit networks. It will also develop a productization roadmap.

The trial participants

The full list of disclosed participants are: the central banks and monetary authorities from Australia, Czechia, France, Germany, Singapore, Taiwan and Thailand, among others. Commercial bank and market infrastructure participants included ANZ; Citibank; CLS Group; DBS; Deutsche Bank; DTCC; HSBC; Hua Nan Commercial Bank; Intesa Sanpaolo; NatWest Group; Santander; Société Générale; Standard Chartered; Sumitomo Mitsui Banking Corporation; The Shanghai Commercial & Savings Bank, Ltd; The Standard Bank of South Africa; United Overseas Bank, and Westpac Banking Corporation.