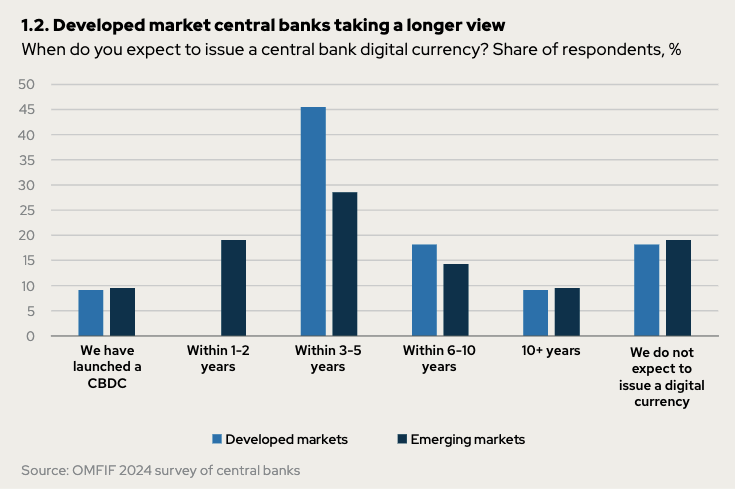

Think tank OMFIF has conducted its latest survey on central bank digital currency (CBDC), finding that almost three quarters (72%) of central banks surveyed intend to issue a CBDC. Most of them (48% of respondents) plan to issue within five years, including 12% within the next two years.

All the near term issuances will be in emerging market economies.

The survey rarely differentiated between retail CBDCs that target consumers, versus wholesale CBDC aimed only at institutions. The work involved in issuing a wholesale CBDC is considerably less because it’s not a major step change – banks already have central bank reserves, this is simply a version with new technology.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.