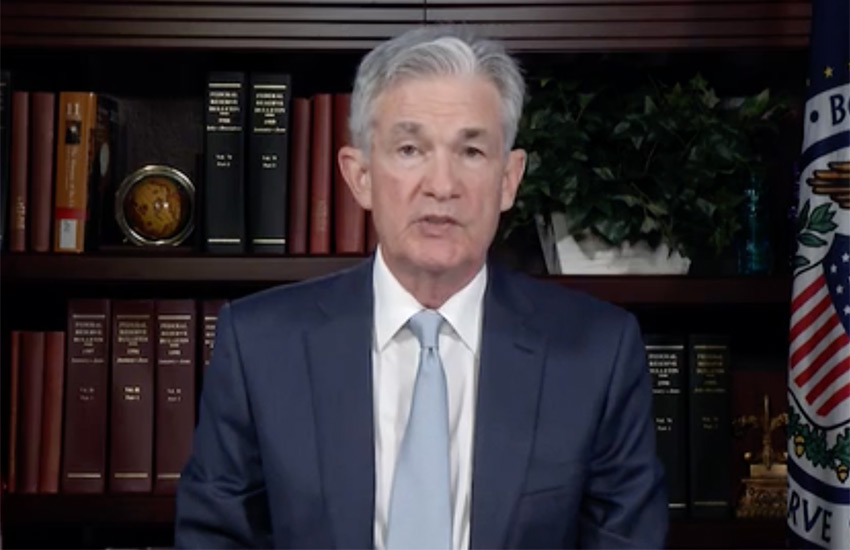

U.S. Federal Reserve Chair Jerome Powell said it would consult the public about a potential central bank digital currency (CBDC) in the summer. He acknowledged both the benefits and risks of stablecoins, hinting that new regulations are coming. Given the growth in US-based stablecoin USDC from $2.9 billion to $18.7 billion in just six months, and the soon-to-be-released Diem (formerly Libra) dollar stablecoin, that’s no surprise.

This was more than a press release. Powell gave a prepared speech to camera to accompany the announcement. The takeaway is that these topics are high on the agenda.

Until now, the Federal Reserve has seemed a little reticent regarding a digital dollar, despite the Boston Federal Reserve conducting research with the Massachusetts Institutes of Technology (MIT). This announcement had a different, more pro-innovation tone. And perhaps a sense of urgency?

“Stablecoins aim to use new technologies in a way that has the potential to enhance payments efficiency, speed up settlement flows, and reduce end-user costs,” said Powell. But he also noted they pose risks because they don’t provide consumer protections and can impact the broader financial system.

He continued, “Therefore, as stablecoins’ use increases, so must our attention to the appropriate regulatory and oversight framework. This includes paying attention to private-sector payments innovators who are currently not within the traditional regulatory arrangements applied to banks, investment firms, and other financial intermediaries.”

Many cryptocurrency trading pairs are quoted against stablecoins. With the cryptocurrency boom, the U.S.-based USDC has grown exponentially, from a market capitalization of $2.9 billion six months ago to $18.7 billion today. The reserves that back the stablecoin are audited by Grant Thornton monthly, with a two-month delay.

The big risk surfaces if stablecoins are suddenly redeemed en masse. With a chunk of reserves held at banks, that could cause massive bank account withdrawals. Not all reserves are in deposits, with some in “approved investments”. Another concern of central banks is the potential market distortion from a radical increase in demand for treasuries or money market funds to be used as stablecoin reserves.

An even bigger perceived risk by central banks is the Facebook-associated stablecoin Diem. If USDC can experience this sort of exponential growth without a userbase like Facebook, how fast could Diem become massive? Just one week ago, Diem announced a move to the U.S. and an arrangement with Silvergate Bank to issue a U.S. stablecoin.

Is a CBDC now more urgent?

So the question is whether Diem and rapid stablecoin growth has triggered a change in the urgency of a CBDC.

“We think it is important that any potential CBDC could serve as a complement to, and not a replacement of, cash and current private-sector digital forms of the dollar, such as deposits at commercial banks,” said Powell.

“As part of this process, we will ask for public comment on issues related to payments, financial inclusion, data privacy, and information security.”

There’s a bit of a domino effect happening here. As Diem readies for launch, the Fed could accelerate a decision to launch a CBDC. Next door neighbor Canada has previously said they were preparing for a CBDC to fend off dollarization from a global stablecoin or US CBDC. So now Canada might accelerate its activities.

Alternatively, the central bank could stop the floodgates opening by imposing regulations. That could delay the stablecoin sector while central banks attempt to catch up.