Shortly before Christmas, Bain & Co and Onyx by JP Morgan published a report on the $400 billion revenue potential from alternative fund tokenization. The figure is based on wealthy investors shifting a proportion of their assets into alternatives.

While people tout tokenization as a tool to democratize investment, the reality is that alternative assets are often inappropriate for retail investors. However, wealthy investors are a different story.

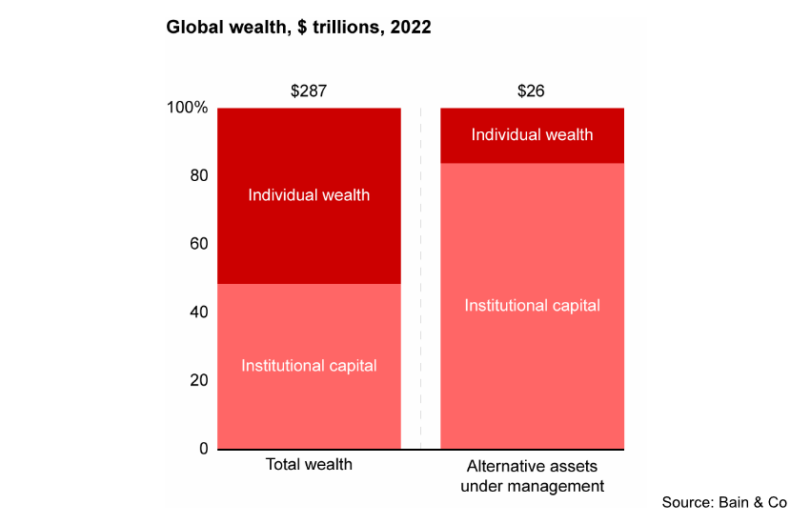

To date alternative asset managers have struggled to expand their reach with high net worth individuals (HNWI), who have just 5% of their wealth in alternatives. That’s despite roughly half of global investable funds sitting in private rather than institutional hands. Currently institutions make up well over 80% of the alternatives investor base.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.