Today Bitcoin Depot announced a Nasdaq listing by merging with GSR II Meteora Acquisition Corp, a SPAC with around $321 million in cash in a deal worth up to $885 million. Some have raised eyebrows over how anti-money laundering works with Bitcoin ATMs, which is pretty valid given our calculations show that the average user converts more than $2,000 of cash to crypto. But we were also curious about the business model and the absence of an explanation in the investor material.

Despite its name, Bitcoin Depot ATMs let users convert cash to multiple cryptocurrencies: Bitcoin, Ethereum or Litecoin. It has a deal with Circle K convenience stores which accounts for 20% of its transaction volumes.

Before we get into the unexplained business model, the first notable thing is that not all the $321 million in cash will go to Bitcoin Depot. Only up to $170 million goes to the company, with up to $122 million going to selling equity holders, which we assume are Bitcoin Depot stockholders. I would take the cash! If SPAC investors redeem some shares, the cash figures will be smaller.

The first question most investors should ask is, what is the business model? Something along the lines of the company takes X percent of every cash to crypto conversion. Admittedly we read the investor presentation quickly, but we failed to find any description like that.

The company has done cumulative transactions from 2016 to June 2022 of $1.2 billion. Presumably, that means $1.2 billion of cash has been converted to crypto. And this is an $885 million deal.

In the unaudited figures for the 12 months to June 30, the company had ‘revenues’ of $623 million. It means transactions. To arrive at gross profit it deducts direct costs of “selling digital assets” and operating the network of kiosks. Assuming the figure is transactions, it earns around 11% after the kiosk operating costs. So it must charge the punters a crypto markup of around 20% to 25%.

Bitcoin Depot has 7,000 plus kiosks and 25,000 monthly active users. This translates to three and a half users per month per kiosk. At first, that doesn’t sound like a great figure. But it looks like it makes around $233 per user per month or almost $850 per kiosk after direct costs. That’s because the average user is converting more than $2,000 of cash to crypto, which sounds kind of high in the context of anti money laundering.

We’ve established the business is potentially quite profitable, but with increasing regulatory action, it’s a risky sector. For example, in January, Singapore banned all crypto ATMs. Scammers also tend to use crypto ATMs. That said, the company is diversifying by enabling crypto purchases at points of sale.

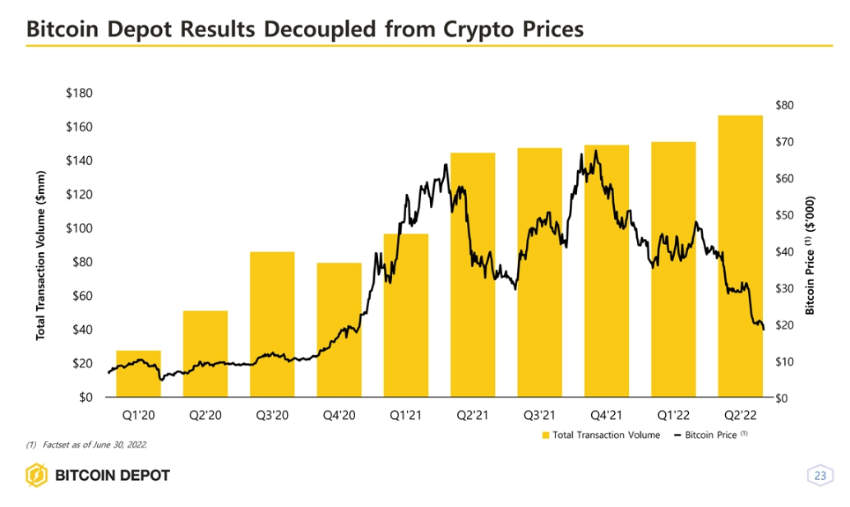

Bitcoin Depot was also keen to emphasize that its ATM volumes are not correlated with the Bitcoin price. It doesn’t explain why, but we can think of one group that may be less sensitive to price: money launderers.

The biggest red flag should be the significant proportion of equity owners heading for the exits. But that would be closely followed by a lack of a clear explanation of its business model. And the massive risk of a crackdown.