Yesterday the House Financial Services Committee voted in favor of the ‘CBDC Anti-Surveillance State Act“. The Bill prevents the Federal Reserve (Fed) from opening digital dollar accounts for individuals. It also bars the Treasury from directing the Fed to issue a central bank digital currency (CBDC) without Congressional approval.

The full House still needs to vote on the Bill, before it goes to the Senate.

In previous hearings, some Democrats also voiced reservations about a CBDC. But yesterday’s debate on this Bill was divided on party lines.

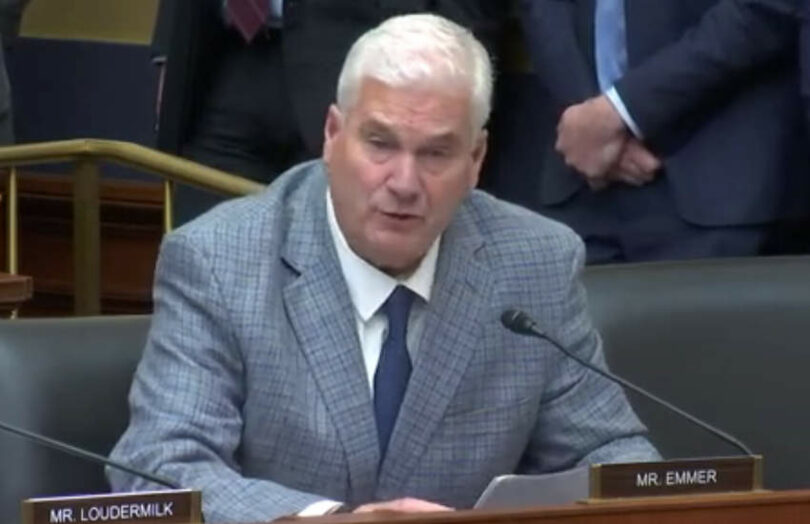

“A CBDC is a government controlled programmable money that if not designed to emulate cash, could give the federal government the ability to surveil and restrict American’s transactions,” said Representative Emmer who introduced the Bill and is Republican whip. “This is not just alarming. It is downright unAmerican.”

CBDC research allowed, but not a pilot

Representative Waters, the Democrat Ranking member of the Committee strongly opposed the Bill calling it the CBDC Anti Innovation Act. She said it would “permanently shut down the important work the Fed is doing to research a potential US CBDC and the benefits different types of CBDC could bring to our payment system.”

However, Republicans clarified that research could continue. But the Federal Reserve cannot build a CBDC.

One of the Democrats who voiced CBDC concerns in a previous hearing, Representative Sherman, positioned the Act as pro-cryptocurrency, something he vehemently opposes. He noted the Bill would prevent a CBDC pilot, and the Fed has already acknowledged the need for Congressional approval for a live retail CBDC issuance.

Republican Representative Davidson objected to the idea of a pilot. “Hiring people in the San Francisco Fed office to build a central bank digital currency is the financial equivalent of allowing the Empire from Star Wars to build the Death Star, so long as they promise not to turn it on,” said Davidson.

CBDC objections: Privacy, Competition, China

The primary Republican argument was the privacy risk of a digital dollar. However, Republican Representative Sessions raised the competition issue. “I think what we’re looking at is the encroachment of government to do something that competes against a robust marketplace that’s the best in the world. That is why Republicans oppose this,” said Representative Sessions.

This was the main issue that seemed to concern a couple of Democrats in last week’s hearing. Particularly the potential impact on the ability of local banks to make loans.

China came up on both sides. Republicans don’t want to emulate China’s surveillance state. The Democrats are concerned about maintaining the international role of the dollar.

“The Chinese CBDC, the eCNY, is already involved in both wholesale and retail CBDC pilot projects with other central banks around the world, aiming to trade directly with each other’s currencies instead of going through the U.S. dollar or dollar based exchanges,” said Representative Waters. “This raises grave concerns regarding the efficacy of US sanctions and financial crime laws.” She mentioned Project MBridge, the cross border CBDC project involving the central banks of China, Hong Kong, Thailand and the UAE.

MBridge is a wholesale CBDC project. The Bill mainly targeted retail CBDC but its loose wording would likely encompass a wholesale CBDC as well. Some financial services firms are keen on a wholesale version, even if they object to a retail CBDC.

On a similar point, the recent BRICS meeting failed to create a new digital currency. However, BRICS members agreed to increase their usage of local currencies for cross border trade. Six new countries will join BRICS by the end of the year. That will mean two BRICS members (China and soon-to-join UAE) are using MBridge. A third, India is already conducting cross border CBDC work with the UAE.

CBDC coverage starts as 1 hour 53 minutes