Depending on the results of Sunday’s elections, Argentina could table legislation to support a central bank digital currency (CBDC) very soon. We previously reported that Economy Minister Serio Massa used the promise of CBDC as part of his election campaign. The leading candidate, Javier Milei, plans to adopt the U.S. dollar.

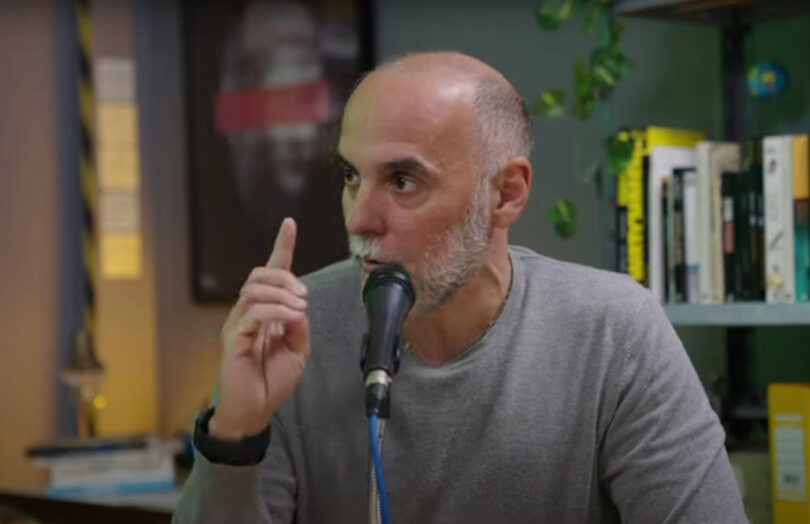

During a Youtube conversation, Agustín D’Attellis, a director at the Central Bank of Argentina, said the draft law would be tabled imminently. He discussed the motivations behind a CBDC, but also revealed he dabbles in cryptocurrency, with accounts at OKX and Binance. There was even some debate about the potential to use Bitcoin for CBDC reserves.

Before introducing a CBDC, the government wants to improve the degree of digitalization in the economy. Increasingly people use cash, so there’s a very large informal sector. He gave the example of restaurants offering a 10% discount for cash payments. This results in a substantial tax burden on those who can’t escape taxes. If there’s greater digitalisation, including using digital wallets, this will expand the tax base and tax rates could come down.

Hence Argentina would initialy target something like Brazil’s Pix digital payments app, which is not a CBDC.

A second stage would be a CBDC based on blockchain. A national public blockchain is also something that’s being considered.

The central banker is interested in the concept of tokenization. In line with the instability of the Pesos, Argentinian savings are often in cash holdings of dollars. Hence, they miss out on growth opportunities. He believes tokenization might break this systematic behavour of buying dollars and encourage investment in real assets, thereby creating a virtuous circle.

A CBDC backed by Bitcoin?

One of the presenters suggested the CBDC could be backed by Bitcoin reserves, at least in part. During the jocular back and forth, Mr. D’Attellis’ initial reaction was “to have Bitcoin as the reserve, it’s not a bad idea.”

However, he partially backtracked, saying, “I don’t think it’s a good idea. There are several issues.” But he suggested solutions.

Firstly, there would need to be a change in the central bank’s charter because it is not permitted to hold crypto as a reserve. And secondly, there’s the issue of Bitcoin’s price volatility. For this Mr. D’Attellis suggested adding a financial instrument to reduced the volatility. The presenters also discussed Argentina’s excess nuclear energy that could be directed towards Bitcoin mining.

However, the topic is moot as it depends entirely on the outcome of Sunday’s elections.