The pandemic has seen companies race to raise money to stay afloat during the virus. Yet, the issuance process remains slow, costly and encumbered by legacy systems. Technology can help reform the process and give companies the funds they so badly need.

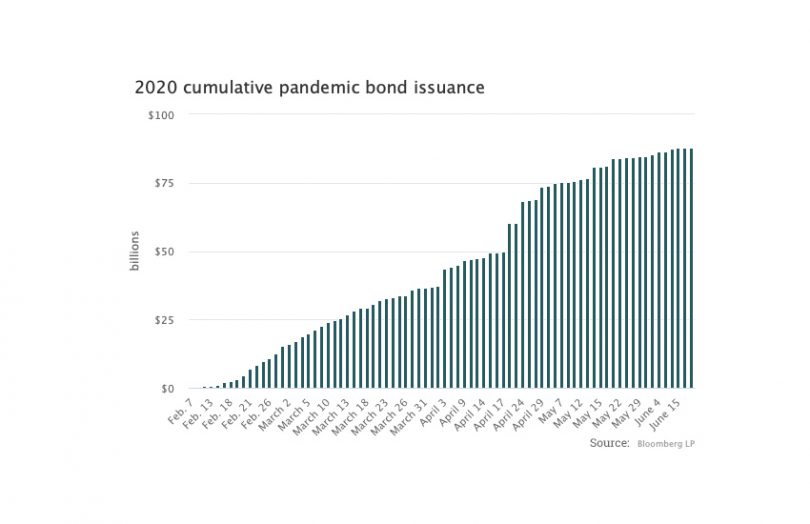

According to Bloomberg, global corporate bond issuance is on track to reach a historical high in 2020, as total capital raised neared $6.4 trillion (June)— already 71% of 2019’s total.

But the process of issuing bonds is unbelievably slow and largely manual. It takes an average of 30 stages with human intervention at each point, including physical paperwork and contact between multiple parties and intermediaries.

The fact that so many of these processes are still multi-step and using people and paper is archaic and inefficient in normal market conditions.

During the lockdown, it looks positively stone-age. And then there is the risk of data leakage and security, which are horribly compromised by existing processes. Two years ago, I visited Credit Suisse’s office on Madison Avenue where they told me that they send 20,000 to 30,000 faxes a day to carry out activities that could be very easily automated and digitized: a scary thought from a data security perspective.

It seems odd that in a world where we are used to securely accessing our personal finances at the click of a button, the same cannot be true for business finance.

This is a massive, liquid market. It needs modernizing. Add to that the fact that volumes have ballooned as crisis hit firms work to raise working capital. That process should be entirely digitized and speeded up.

There is no question that technology is the key here. There are solutions to digitize the entire process, allowing businesses to greatly reduce their time to market and their banks to provide a vastly improved service to their corporate customers.

When normal ways of working are disrupted, it brings to light the inefficiencies in document workflows that cost businesses thousands of dollars in fraud each year, not to mention the other cost of lagging behind due to outdated processes.

There is now an opportunity to take the lessons learned from the pandemic and digitize processes that have shown they need it. Companies owe it to the parties they do business with to explore and apply ways to do things better, faster and more securely. That applies even more so in challenging conditions where people are physically distanced.

Jesse Chenard is the CEO of MonetaGo, which provides blockchain solutions for trade finance, commercial paper and bond issuance.