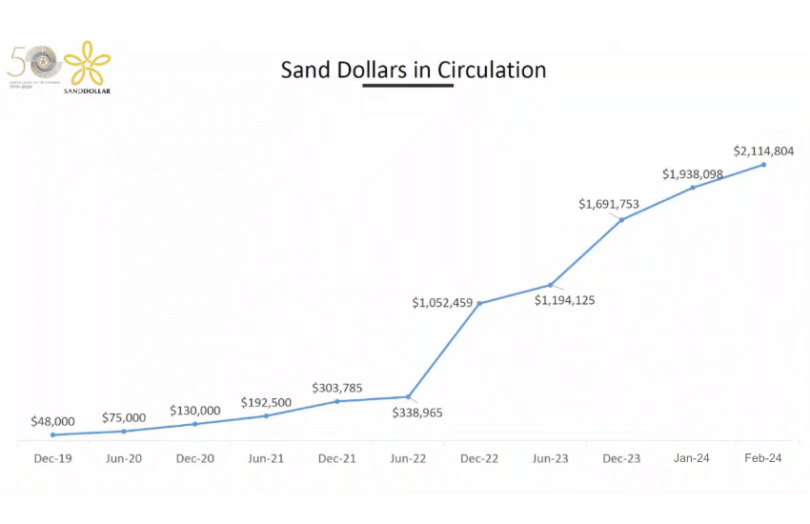

Last week Shaqueno Porter of the Central Bank of Bahamas provided an update on the progress of the Sand Dollar central bank digital currency (CBDC). He was talking during the Digital Euro Conference. After launching the Sand Dollar in late 2020, Mr Porter revealed that the current amount in circulation is $2.1 million, representing less than 0.5% of cash in circulation. (The Bahamian dollar is pegged to the U.S. dollar.)

The number of Sand Dollar wallets looks more positive at 120,000 out of a population of just over 400,000. However, tourists can also download the wallet, and last year the islands received almost six million visitors in the first seven months alone. There’s no need for KYC for small transaction levels in Tier 1 of the Sand Dollar, making tourist adoption easier.

Stepping back, emerging economies and particularly Caribbean islands, have different motivations from advanced economies. Hurricanes frequently strike the Bahamas, knocking out banks. Hence, there is a desire to create an alternative system to reduce reliance on banks during such events.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.