Consulting firm Bain & Co recently published a report outlining its strategy thoughts for incumbents addressing the digital asset space.

Bain identifies the three sectors that offer the best digital asset opportunities as the private markets for equities, bonds and real estate. The attraction isn’t just the significantly larger size of the private markets, but the compound growth rate is four times that of public markets over the past 20 years.

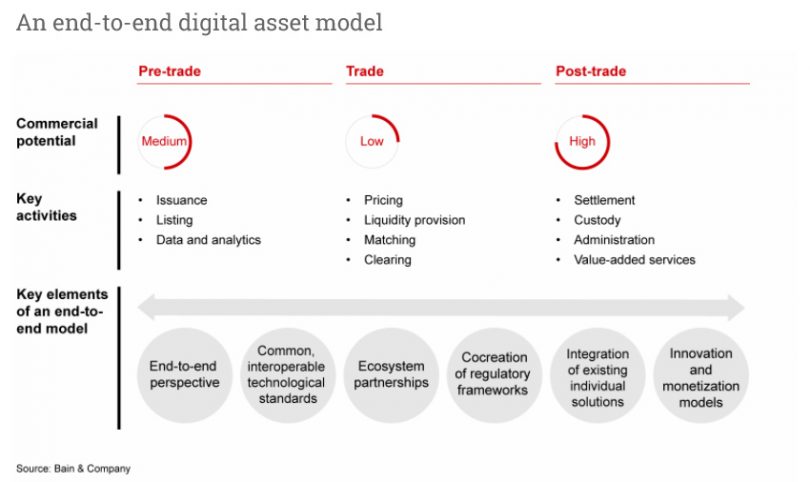

Talking to Mike Kühnel, Bain & Co partner and co-author of the report, he described what at first seems an ambitious strategy. He suggests that the infrastructure needs to be end-to-end when addressing digital assets, as in covering pre-trade, trade, and post-trade. Additionally, he is negative about local propositions and prefers a global strategy.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.