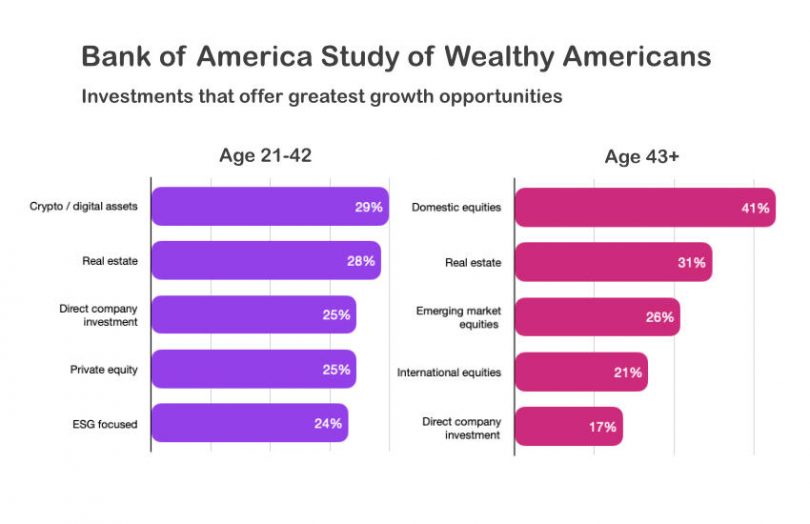

It’s widely known that cryptocurrencies appeal to younger audiences. However, the Bank of America survey of wealthy Americans conducted by its Private Bank found that younger generations are far less enamored by the stock market. Not only did digital assets feature in the top slot for growth opportunities for those aged 42 or less, but public stocks didn’t make it into the top five.

These statistics reinforce the repeated refrain at the SIBOS banking conference this week: banks are following customer demand, and retail customers are interested in cryptocurrencies.

Stocks make up a quarter of the portfolio of the 21-42 year olds, compared to 55% for their elders. These are all households with a minimum of $3m in investable assets.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.