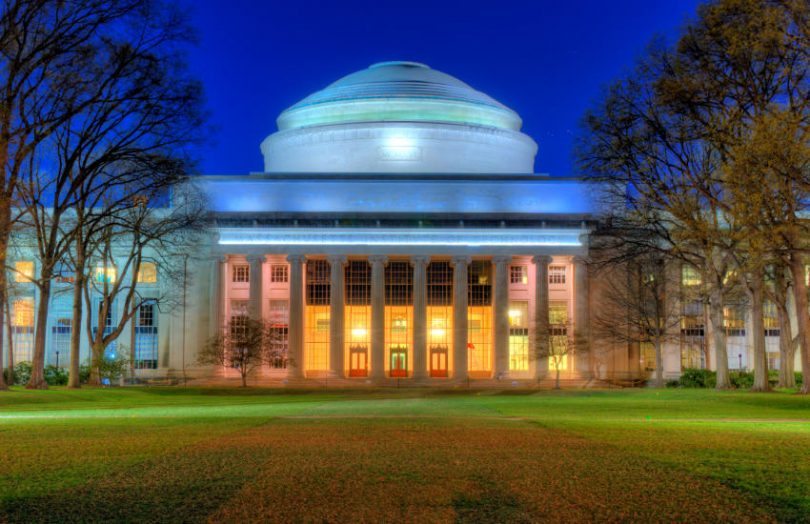

Today the Bank of Canada announced it will work with the Massachusetts Institute of Technology (MIT) for its central bank digital currency (CBDC) research. The twelve month project is with the MIT Media Lab Digital Currency Initiative (DCI), the same group that is working with the Federal Reserve Bank of Boston on Project Hamilton.

As with Project Hamilton, the focus is on experimenting with different technical approaches. And the Bank of Canada emphasized that it has not yet made a decision about issuing a CBDC.

Previously the central bank has cited the launch of a U.S. digital dollar as a possible trigger for Canada to launch its own because of concerns that Canadians might start to use U.S. dollars to a greater extent. President Biden’s digital assets executive order set a concrete timeline for a U.S. CBDC report and legislative agenda, effectively accelerating the United States’ research efforts.

The Bank of Canada has been exploring CBDC for several years. A year ago, it ran a university competition and published the winning three papers.

For its part, MIT’s DCI has a particular approach. For several years the DCI has contributed code to Bitcoin core, and it looks to leverage some of the benefits of cryptocurrencies in its CBDC work. However, in its U.S. work on Project Hamilton, the decision was to sidestep the use a blockchain to avoid slowness, but it uses the same unspent transaction output (UTXO) that Bitcoin uses. MIT’s DCI releases all its work as open source.

One of the values that underpins DCI’s work is user agency, giving users control over their own data and being concerned about privacy. Unlike physical cash, few central banks are likely to allow anonymity because of money laundering concerns. The next best thing is to keep transactions private. The potential loss of cash’s anonymity is a major societal issue that isn’t fully appreciated. Leaders can be replaced by less benevolent ones who could restrict access to digital currency.