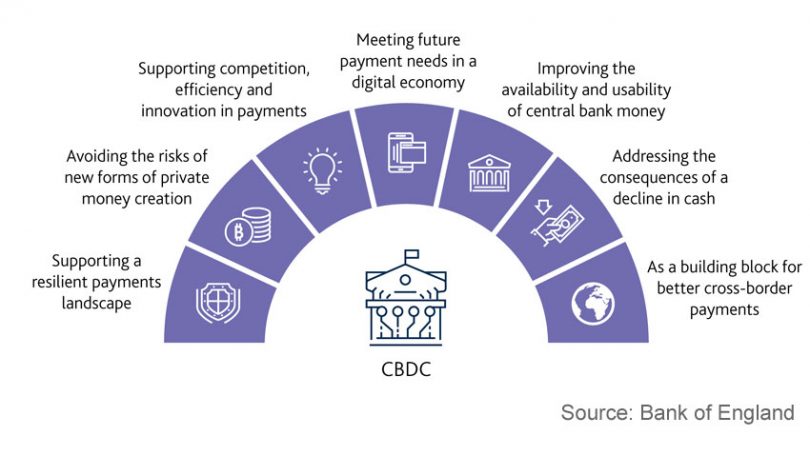

Today the Bank of England published a discussion paper: “Central Bank Digital Currency: opportunities, challenges and design”. It also plans to run a webinar in early April.

The paper starts by outlining one of the drivers behind a consumer-focused Central Bank Digital Currency (CBDC) – the declining use of cash.

In 2006, 63% of payments were cash, and 13% used debit cards. In 2018 just 28% of volumes used cash, and 39% of payments were via debit cards, with increasing use of automated bank payments and credit cards. So the Bank asks, as the most trusted issuer, should it offer electronic money to complement cash?

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.