Yesterday the Bank of Japan (BoJ) published a research paper on central bank digital currency (CBDC). As with previous papers, the Bank explored a specific topic, in this case, the potential offline use of a digital yen.

Although it’s a research paper, the Bank recognizes there will be a growing need for a digital currency with the steady decline in the use of cash. However, in Japan, four out of five retail transactions still use cash.

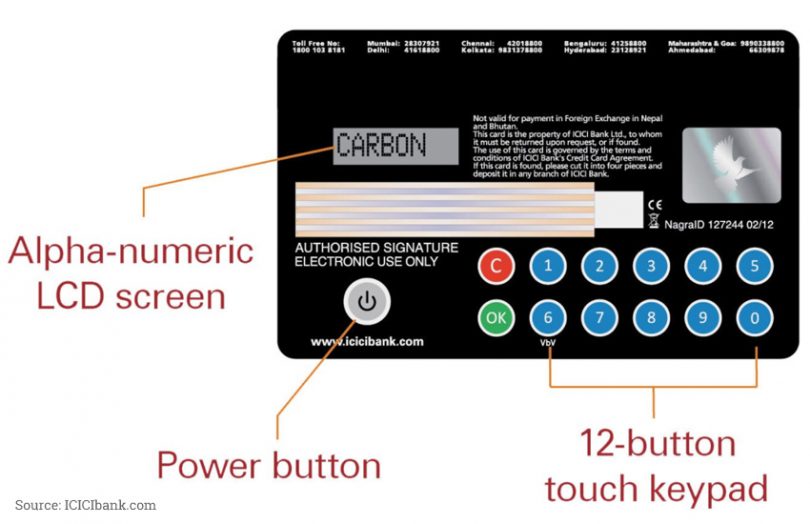

The Bank considers two critical features of a CBDC are universal access and resilience. That means using the digital yen without electricity, especially given Japan’s recent earthquakes and power outages.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.