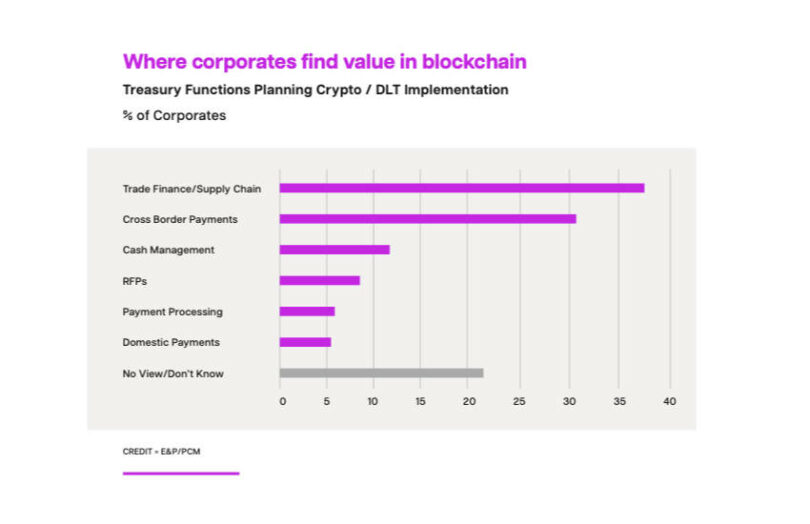

Late last year, research involving 830 large corporates found that corporate treasurers and CFOs want to use blockchain, particularly for supply chain, trade finance and cross border payments. However, the corporate view is that banks are not keeping up. The report authors east & partners and PCM warn that banks need to move faster or risk new competitors leveraging stablecoins to offer corporates the services they demand.

The researchers note that banks no longer rank as major players in personal cross border money transfers, with banks charging almost double their most expensive non-bank competitor. However, consumer-to-consumer cross border payments are just $800 billion a year compared to a B2B figure of $150.7 trillion according to EY. So there’s a lot for banks to lose.

More than three quarters of companies said that blockchain solutions were medium or high priority for their corporate treasury teams, with China and the USA leading the way. However, there could be some bias because to participate in the research, the treasurer or CFO required some understanding of CBDC, stablecoins, blockchain or cryptocurrency.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.