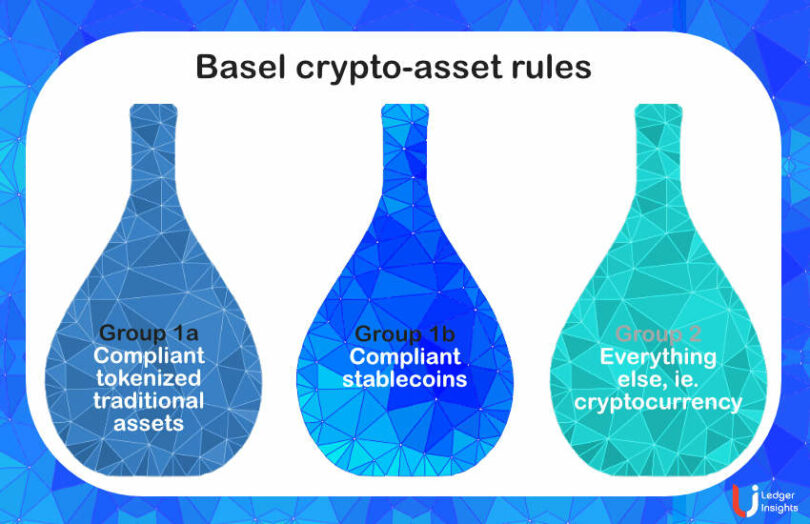

During an event today, Giovanni Sabatini, the Director General of the Italian Banking Association (ABI), called for a level playing field regarding crypto asset regulation. He was discussing the final Basel crypto rules requiring banks to give a 1250% risk weighting for cryptocurrencies (Group 2 crypto-assets). That often means setting aside a Euro of capital for every Euro of crypto Exposure. Additionally, the Basel rules cap the exposure to 2% of Tier-1 capital.

Sabatini described the rules as “quite conservative,” although recognizing the need for prudential treatment.

“We believe there may be still room for improvement of this prudential scheme,” said Sabatini. “Banks are penalised since they would not compete on an equal footing with other entities, i.e., FinTechs, BigTechs and new players like Crypto-Asset Service Providers (CASPs), which are not subject to the same capital requirements.” He noted that proposed European laws (MiCA) have less strict provisions on CASPs.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.