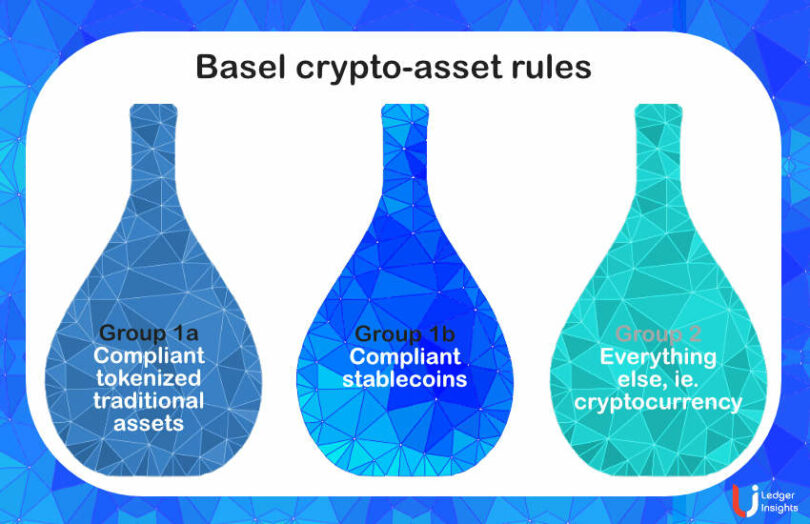

During an event today, Giovanni Sabatini, the Director General of the Italian Banking Association (ABI), called for a level playing field regarding crypto asset regulation. He was discussing the final Basel crypto rules requiring banks to give a 1250% risk weighting for cryptocurrencies (Group 2 crypto-assets). That often means setting aside a Euro of capital for every Euro of crypto Exposure. Additionally, the Basel rules cap the exposure to 2% of Tier-1 capital.

Sabatini described the rules as “quite conservative,” although recognizing the need for prudential treatment.

“We believe there may be still room for improvement of this prudential scheme,” said Sabatini. “Banks are penalised since they would not compete on an equal footing with other entities, i.e., FinTechs, BigTechs and new players like Crypto-Asset Service Providers (CASPs), which are not subject to the same capital requirements.” He noted that proposed European laws (MiCA) have less strict provisions on CASPs.

We observe that this is deliberate because regulators want to ringfence crypto risks from the traditional finance (TradFi) sector. Otherwise, if there was a crypto contagion, people with no interest in cryptocurrency could suffer losses from bank failures. Or governments might be left to foot the bill in bailing out banks. Nonetheless, banks are unquestionably at a disadvantage compared to startups. Longer term this could mean that these newcomers usurp banks.

Sabatini noted that banks are capable of imposing appropriate safeguards, comparing them to the “less reliable actors” evidenced during the crypto fallout.

“I am strongly convinced that we need a more comprehensive regulatory framework that goes beyond the traditional approach (including increasing prudential requirements on regulated entities) that ensures that the risks and challenges posed by crypto assets are adequately addressed independently from the entities that deal in those assets,” concluded Sabatini.

Earlier this month, the European Parliament voted on a draft version of temporary rules that would impose the 1250% risk weighting while it works on more detailed regulations implementing the Basel rules. In the meantime, the European Central Bank (ECB) has said that banks are “expected to comply with the standard” despite the fact that legislation has not yet been passed.