The Bank for International Settlements published a report on Basel III, the risk assessment framework, which has a new segment for crypto-asset reporting. Only 19 out of 182 banks reported crypto-asset exposures at the end of 2021, and two are purely crypto banks. The banks are unlikely to be the largest, as their combined assets represent just 2.4% of all the banks that reported. In terms of risk exposures, crypto-assets represented 0.01% of all exposures.

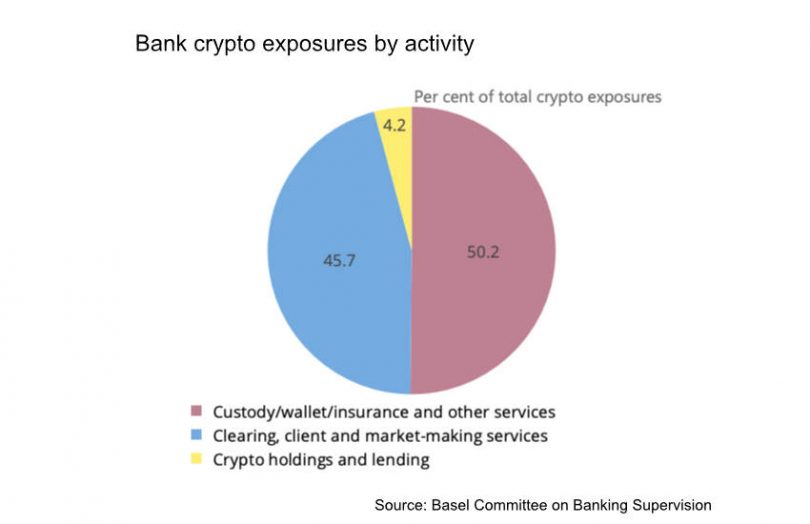

The total of all crypto exposures was €9.4 billion ($10.7bn at the end of 2021). In context, the total market capitalization of crypto at the end of last year was $2.7 trillion. In other words, banks accounted for much less than one percent of crypto-assets. That said, there have been some significant bank announcements during 2022.

And of those 19 banks that had some exposure, three made up two-thirds of the figures and the top six banks accounted for 92% of the crypto-assets. Unsurprisingly, almost 90% of the crypto-assets were invested either in Bitcoin or Ether, although via a variety of mediums such as direct, through Grayscale trusts and ETFs. Most of the rest of the crypto were the tokens of other layer 1 blockchain networks, although there were smaller amounts in the USDC stablecoin and tokenized assets.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.