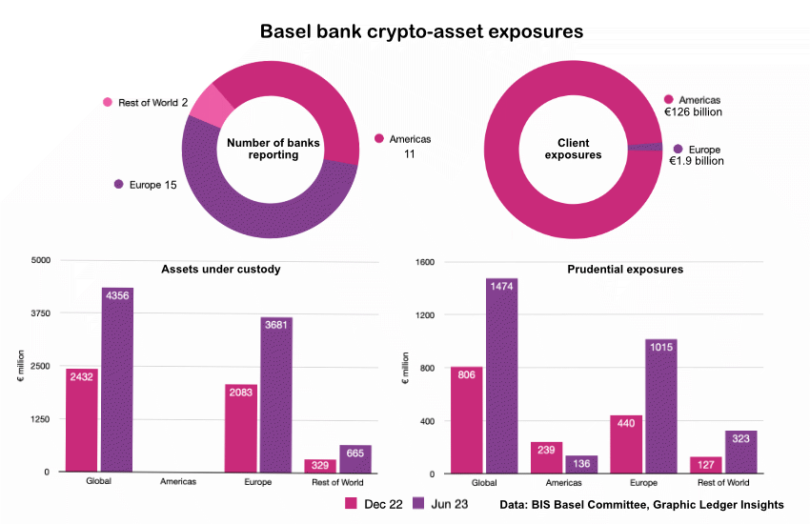

Today the Basel Committee on Banking Supervision (BCBS) published the latest Basel III monitoring report, which gathered data on 177 banks globally. Just 28 banks disclosed crypto-asset exposures for the six months to June 30, 2023. Digital asset custody figures rose 79% to €4.4 billion across all banks. However, comparatives may not be reliable.

American banks are largely absent from the custody sector, with just €11 million under custody across 11 banks. This can be primarily attributed to the SEC accounting rule (SAB 121) that makes it prohibitive for U.S. banks to provide digital asset custody.

European banks dominate digital asset custody with €3.7 billion held in custody, almost all spot cryptocurrencies. Two banks in the ‘rest of the world’ provide custody for €665 million, also for spot crypto.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.