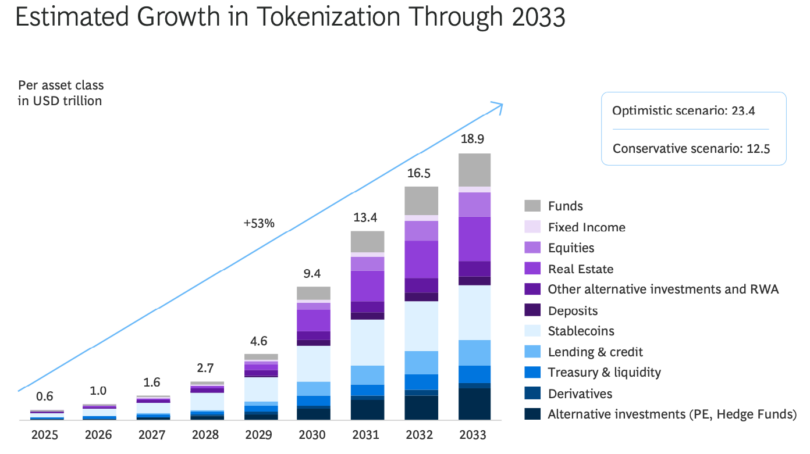

Yesterday Ripple published a tokenization report developed by Boston Consulting Group (BCG), which predicts tokenized assets will reach $18.9 trillion by 2033, including stablecoins and tokenized deposits.

The report outlines three stages of adoption. It describes the first phase as low risk adoption, including pilots involving money market funds and corporate bonds. BlackRock’s BUIDL tokenized money market fund launched in 2024 is given as an example, alongside Singapore’s Project Guardian. Rather than attempting to scale, the goal of this phase is institutional readiness.

Phase two starts to involve more complex assets such as private credit, structured finance and corporate bonds. The aim is to earn a return, enhance liquidity and enable composability, as opposed to the simpler transactions in the earlier phase. This is when institutions start to move beyond private blockchains to explore permissioned public blockchains. However, BCG observes some reluctance from institutions to collaborate to reshape markets as they want to defend existing revenue streams.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.