Yesterday the Bank for International Settlements (BIS) published its latest survey about central bank digital currencies (CBDC). Sixty central banks responded in late 2020. The headline conclusion is that central banks representing a fifth (20%) of the world’s population will issue a digital currency within the next three years. China is heavily piloting its digital yuan and the country accounts for roughly 18% of the global population.

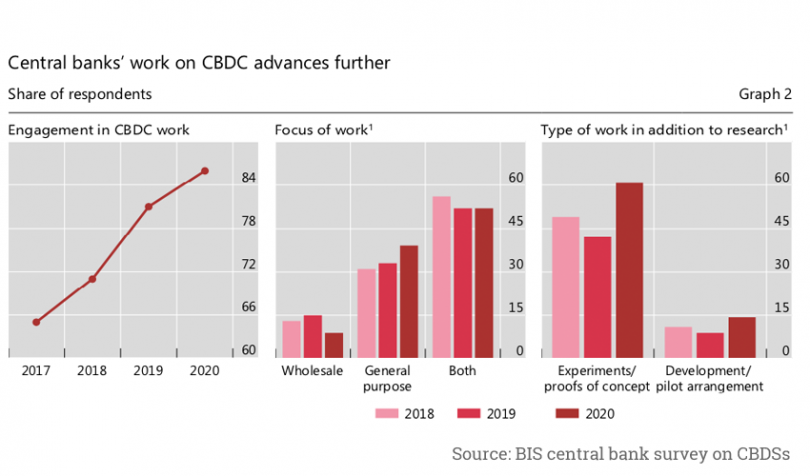

While the 20% figure may be the same as 2019, all other activity was up across the board. In 2019 only one advanced economy was considering issuing a CBDC within the next six years. In 2020 that figure increased to 20% of advanced economy central banks.

However, 60% of central banks are still unlikely to issue a CBDC within the next six years. 86% of central banks are engaged in some sort of CBDC activity, whether that’s research, proofs of concept or pilot development. There is an uptick in the more advanced activity of PoCs and pilots.

While the overall figures point to an increase in activity, it’s notable that the make up of the central banks changed significantly. For example, half of central banks that previously said any kind of CBDC was likely within six years have since downgraded their estimation to possible or unlikely. So while some have pushed back plans, others have accelerated them.

There is also a shift with less activity in wholesale CBDC and more retail CBDC.

CBDC Motivations

Emerging markets account for seven of the eight central banks in advanced stages of CBDC work. Emerging markets are more motivated to issue a CBDC, whether that’s a retail CBDC for the general public or a wholesale CBDC for the banking sector. For retail CBDCs, the emerging market motivation is significantly driven by a desire for greater financial inclusion, although domestic payment efficiency is a close second.

Improving cross border payment efficiency ranked sixth in the top six reasons for a retail CBDC in emerging markets, and fourth or fifth for advanced economies. However, cross border efficiencies ranked a little higher when the same question was asked about wholesale CBDCs.

The survey also explored cryptocurrencies that are still seen as niche. Two thirds of central banks are investigating how stablecoins might impact monetary and financial stability.

The BIS also highlighted the “arrival of a ‘live’ general purpose CBDC” when the Bahamas issued the Sand Dollar in October 2020.