Yesterday, the Bank for International Settlements (BIS) published the results of its

survey on central bank digital currency (CBDC). While most banks are still researching the implications, the BIS says central banks representing one-fifth of the globe’s population could issue a CBDC soon. Although not singled out by the BIS, China’s high profile digital currency / electronic payment (

DC/EP) accounts for a significant proportion of that.

However, 70% of central banks still say they are unlikely to issue a CBDC in the foreseeable future. The big news is that 10% envisage adopting a general purpose CBDC in the short term (within three years).

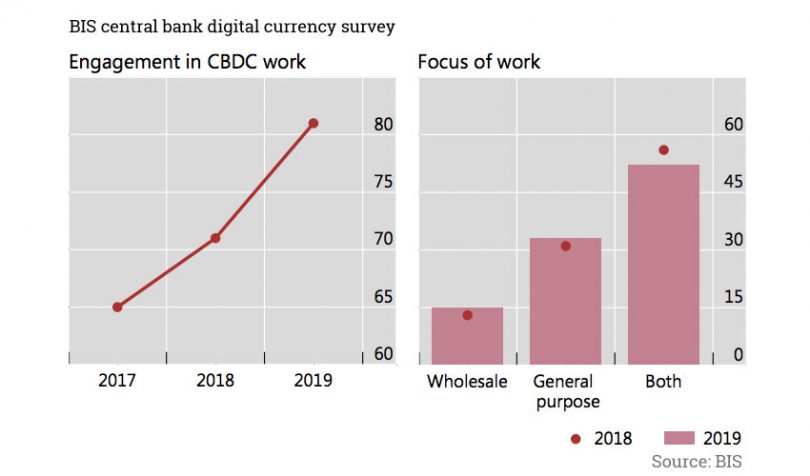

Exploration has accelerated. While 70% of central banks were exploring digital currencies last year, the figure is now 80%. In terms of progress, half of the active banks are still at the pure conceptual research stage, 40% have conducted experiments, and 10% are at the pilot stage. The latter group were all in emerging markets.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.