Today the Bank for International Settlements (BIS) released its latest research on central bank digital currencies (CBDC). It found countries that are currently working on or exploring a CBDC tend to have high mobile phone usage and strong innovation capacity. It introduced novel ways of tracking CBDC interest and designs and explored three of the most significant CBDC projects in China, Sweden and Canada, with some interesting perspectives.

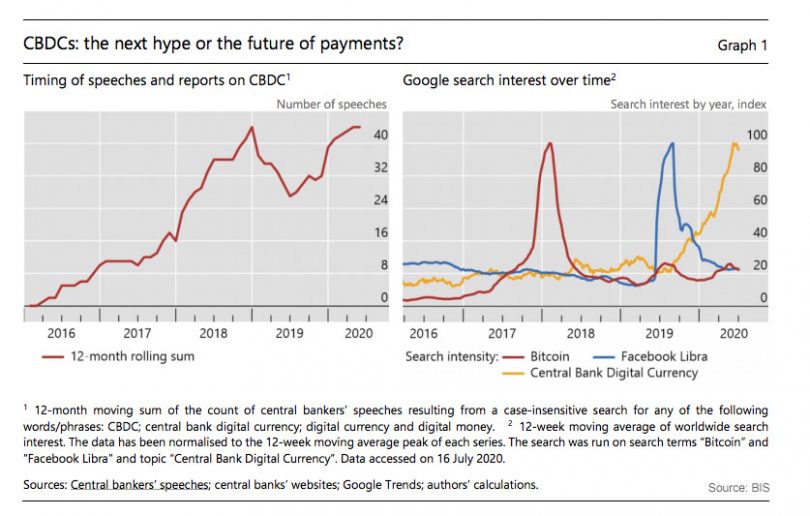

The graph highlights the increasing interest in the topic from both central banks and the public. It’s notable that the internet search index has more than doubled since the start of the year. One contributing factor is the leaked information about China’s CBDC tests, which made the prospect of a CBDC far more concrete. Another is the inclusion of digital currency in U.S. COVID-19 stimulus bills. This supports the BIS observation that central bank activity will spur public interest.

CBDCs are divided into institutional or wholesale CBDC, which are not considered as big a challenge compared to retail CBDC.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.