Today the Bank for International Settlements (BIS) released its latest research on central bank digital currencies (CBDC). It found countries that are currently working on or exploring a CBDC tend to have high mobile phone usage and strong innovation capacity. It introduced novel ways of tracking CBDC interest and designs and explored three of the most significant CBDC projects in China, Sweden and Canada, with some interesting perspectives.

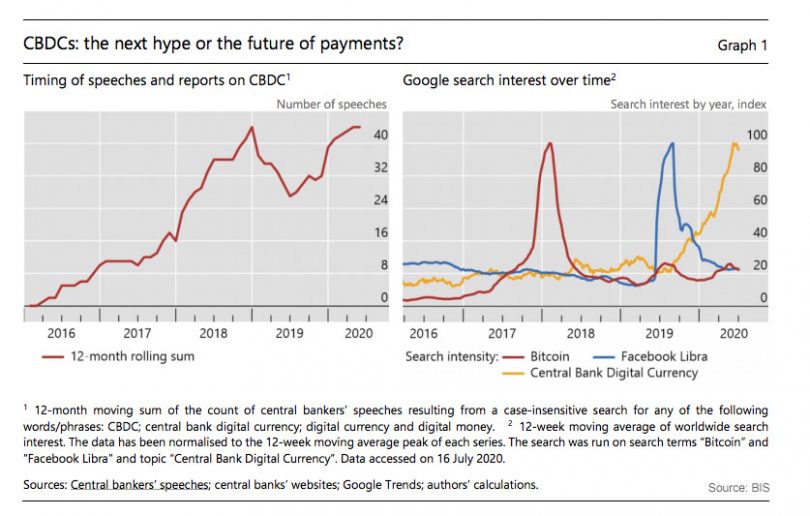

The graph highlights the increasing interest in the topic from both central banks and the public. It’s notable that the internet search index has more than doubled since the start of the year. One contributing factor is the leaked information about China’s CBDC tests, which made the prospect of a CBDC far more concrete. Another is the inclusion of digital currency in U.S. COVID-19 stimulus bills. This supports the BIS observation that central bank activity will spur public interest.

CBDCs are divided into institutional or wholesale CBDC, which are not considered as big a challenge compared to retail CBDC.

In terms of policy choices for retail CBDC, there is a tendency towards an intermediated approach where central banks delegate the customer facing aspect. However, a few are considering taking on that role. There is a strong tendency towards a direct claim on the central bank, with none exploring an indirect claim or synthetic digital currency. Simplistically, that’s where fully backed stable coins or wallets hold the money at central banks.

For retail CBDC, there is greater interest from economies with large informal sectors. That’s because the authorities are keen to get a view on the hidden parts of the economy. However, there may be a desire by users to remain below the radar, which could impact the use of a CBDC (our view, not the BIS).

The BIS highlighted that there’s significant inertia in retail payment systems. Hence it concludes that increased use of digital payments as a result of COVID-19 could have a far reaching impact. Another inertia conclusion (not from the BIS) is that some CBDCs might struggle to gain traction unless they offer significant advantages over existing private digital payments.

There is a perception in the Chinese press (not a BIS observation) that consumers may perceive the digital yuan or DCEP as increasing government oversight. The BIS paper clarifies that users can remain anonymous to each other, but that transaction data will be sent to the central bank. Previously there was some lack of clarity about whether or not smaller transactions would go to the central bank. But for smaller transactions, KYC will not be required.

As previously disclosed, the People’s Bank of China (PBoC) will not rely on distributed ledger technology (DLT) for the digital renminbi, because it doesn’t believe it is sufficiently scalable to support 300,000 transactions per second. However, the BIS reveals that it will use DLT in some way. The question is how or for what role? It’s already public information that intermediaries are free to use the technology of their choosing.

On the topic of DLT, the BIS report highlighted the technology used by a group of central banks running prototypes. Seven are using DLT, three conventional technologies and one is using both.

This is one of several reports issued by the BIS. Others include an exploration of technical approaches, the role of CBDC in ensuring competition in private payments, and a BIS survey that concludes a fifth of the world’s population will soon be using a CBDC.