Today the Bank for International Settlements (BIS) published a paper on central bank digital currencies (CBDCs) and the future of cross border payments. As numerous central banks explore CBDCs, there’s a natural focus on domestic requirements. The BIS hopes to encourage banks to explore cross border payments at the design stage and outlines three potential approaches.

The paper highlights two reasons why cross border payments have become increasingly challenging.

There has been a decline in the number of correspondent banks, which play a critical role in international payments. These correspondents provide a service so that banks that don’t have accounts at the destination can send money across borders. As an example of the contraction, in Central, South America and the Caribbean, there was a 30% decline between 2012 and 2018.

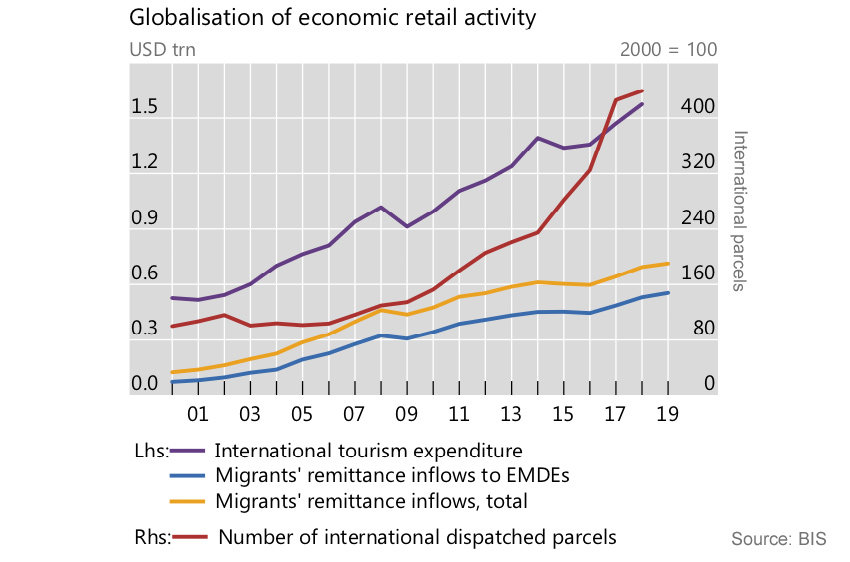

Additionally, consumers have become more aware of the issues because retail use of foreign currencies has grown significantly in the last ten years. That’s especially in cross border e-commerce, travel and migrant labor remittances.

It’s this sort of area that the Facebook-founded Diem (formerly Libra) project plans to address. The project received multiple mentions in the paper. “Multi-CBDC arrangements are preferable to proposals that involve the creation of a private sector global stablecoin,” the paper says.

Some of the current issues with cross border payments include unclear foreign exchange (FX) rates, unpredictable fees, and different opening hours across regions. Additionally, a variety of communication standards are used and there’s limited transparency. There are a large number of intermediaries and a high cost of compliance.

The three models

The first potential model aims to create compatible CBDC systems with common standards for technical areas, message formats and data.

The slow rollout of ISO 20022 highlights this sort of approach’s challenges and aligning legal frameworks would be time consuming. But there are hopes that CBDC might offer a clean slate.

However, a significant proportion of current research focuses on two-tier systems, with private entities taking on the consumer facing role for CBDC distribution. So there’s a risk this could repeat the same issues as currently experienced. And that large incumbent banks might dominate.

The second model is to interlink domestic CBDC systems. But this was likened to trying to connect water pipes with different flow rates. It’s seen as high risk and would involve significant coordination. This route would require a clearing system, either centralized or decentralized.

The third option is to create a single shared multicurrency system with a single rulebook. One potential approach is to adopt a shared corridor as explored in the Inthanon – Lion Rock (Thai Hong Kong) trials. These M-CBDC tests have since been expanded to include the central banks of China and the UAE in association with the BIS Innovation Lab.

The paper concludes, “A CBDC, compatible with others and benefiting from a diverse and competitive market for services, would be a real public good. To achieve this, central banks will need to collaborate.”