Project Genesis is a new initiative from the Bank for International Settlements (BIS) Innovation Hub and the Hong Kong Monetary Authority (HKMA) to encourage sustainable investment by tokenizing green bonds. The hope is that this will make bonds more accessible, with smaller investments required. Additionally, it aims to prove the sustainability claims that underpin the bonds.

“Green and digital are not only interconnected but interdependent – the fate of one depends on the other. Green finance, accordingly, is a key priority of the BIS Innovation Hub and Genesis is an integral part of that,” said Benoît Cœuré, Head of the BIS Innovation Hub.

The project will target the full bond life cycle. In other words, the issuance process, payment of interest and redemption. There are two parallel tracks, one on multiple permissioned blockchains, operated by Digital Asset (Switzerland) and its partner GFT Technologies Hong Kong. The second track is the Liberty Consortium which will use a public permissionless blockchain. Consortium members include SC Ventures, Standard Chartered Bank and Shareable Asset.

At the same time, Hong Kong’s Allinfra will be responsible for using blockchain to verify the sustainable use cases.

There’s been a considerable upswing in green bond activity since 2015. And in the last 18 months, there’s been a substantial increase in announcements for projects using blockchain and tokenization for sustainable purposes.

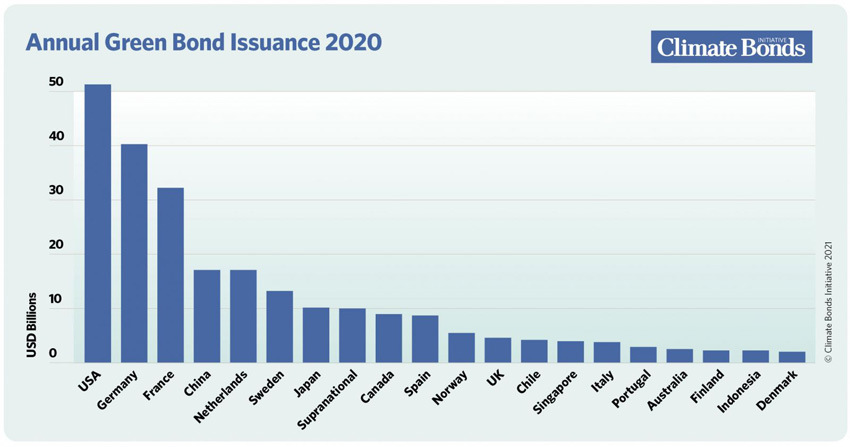

2020 was a record year for green bond issuance at $269.5 billion despite the pandemic, a figure marginally more than 2019. The cumulative figure for issuance passed the one trillion dollar mark for the first time. That’s less than one percent of the global bond market of $123.5 trillion at the end of 2020.

The United States issued the most at $51 billion, similar to 2019, but China fell from second to fourth place, perhaps related to the pandemic. But it’s also eyeing blockchain for green bonds.

Meanwhile, in 2019, HSBC and Sustainable Digital Finance Alliance (SDFA) published a whitepaper on blockchain for green bonds. A few issuances have used DLT, including from German engineering firm Dürr and BBVA was involved with two issuances for MAPFRE and a sustainable “Schuldschein” loan for the Madrid Government.