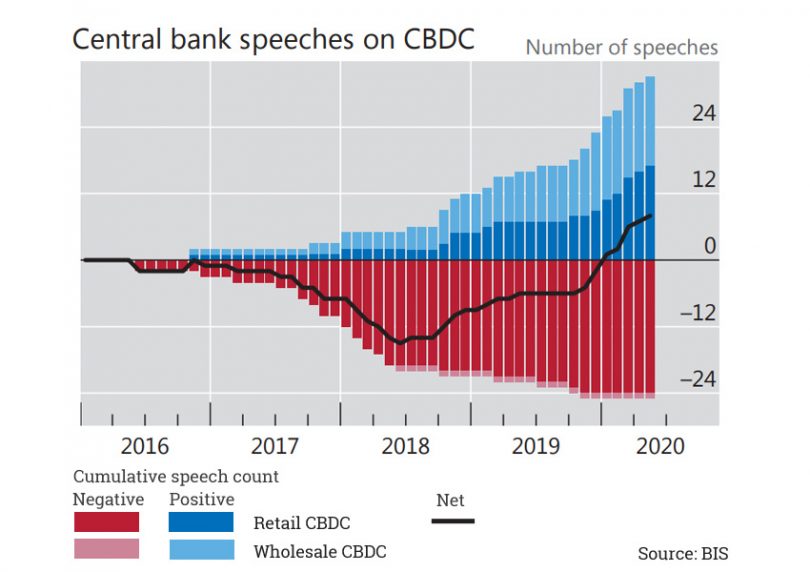

Today the Bank for International Settlements (BIS) published a chapter from its annual report entitled “Central banks and payments in the digital era”. Part of the section covers central bank digital currencies (CBDC), which it considers an increasingly likely option. If there was one takeaway, it was that it sees the role of a central bank as the guardian of private sector competition for payments.

“CBDCs could offer a new, safe, trusted and widely accessible digital means of payment,” the paper states. “But the impact could go much further, as they could foster competition among private sector intermediaries, set high standards for safety, and act as a catalyst for continued innovation in payments, finance and commerce at large.”

It briefly addresses private sector attempts to address the demand for faster and cheaper payments. It references Bitcoin and other cryptocurrencies, Libra’s stablecoin, and big tech and fintech firms’ entrance into financial services.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.