Today the BIS Committee on Payments and Market Infrastructures (CPMI) published its final report on increasing the adoption of payment versus payment (PvP) in foreign exchange (FX) transactions. Apart from reviewing existing PvP platforms, it also explores 11 new ones that have either been released or are under development. At least six of the 11 use blockchain in some way.

The six platforms are 9th Gear, Baton Systems’ Core FX, Fnality, Izzi, Project Jura and RTGS Global. Despite being DLT-based, the Regulated Liability Network (RLN) is not one of the solutions in focus because it was considered conceptual at the time, although it has since progressed.

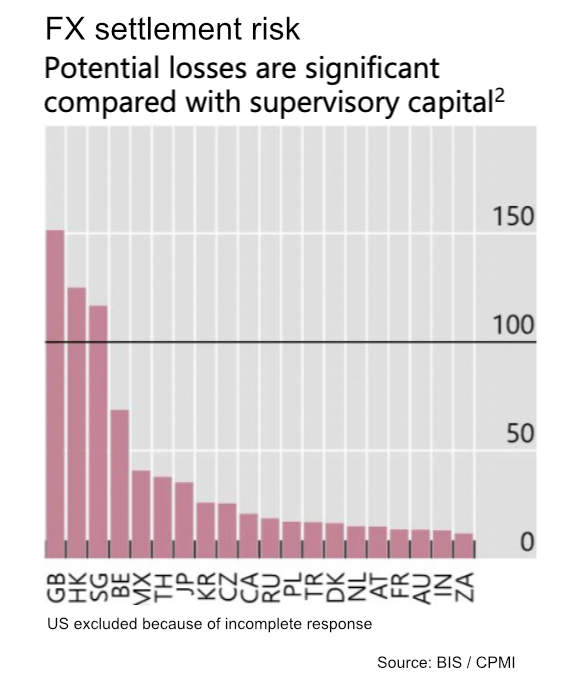

FX settlement risk

The paper follows a July 2022 consultation and is part of the G20 cross border payments program. As with the previous report, it finds that existing PvP arrangements reduce risks and makes recommendations on improving adoption.

While the focus is on the recommendations, it’s worth revisiting why central bankers are so keen to encourage the adoption of PvP.

With FX transactions averaging around $7.5 trillion daily, settlement risks are massive. The July report highlighted the somewhat concerning fact that at least three countries – the UK, Hong Kong and Singapore – have settlement risks that exceed the capital of the banks. Central bankers would deem that a financial stability risk.

Exposures are the highest in the UK, where settlement risks are 150 percent of bank capital. We note that the country is home to three globally systemically important banks (G-SIB), HSBC, Barclays and Standard Chartered. HSBC ranks number one of all the G-SIBs in terms of cross jurisdictional activity, with Barclays as number eight.

Not mentioned in the report is that HSBC is also the key early adopter of one of the 11 new PvP platforms, the only one that is operational – Baton Systems’ Core FX.

The paper states that banks are not always incentivized to adopt PvP solutions for various reasons. These include some banks underestimating the settlement risk. For example, assessing the settlement risk for a single day when the settlement delay spans several days. PvP arrangements are not always optimal for liquidity management, which can make some banks reluctant to use them.

Recommendations

The private sector recommendations include aligning nostro operating hours and improving interoperability between legacy and emerging systems. Unlike most settlement systems, some of the newer platforms tend to support 24/7 operations.

In terms of public sector recommendations, these include:

- Implementing regulatory incentives to adopt PvP

- Exploring PvP providers getting access to central bank accounts

- Considering extending RTGS operating hours to support PvP arrangements

- Investigating interoperability between RTGS systems and PvP systems

- Easing liquidity constraints for PvP settlement