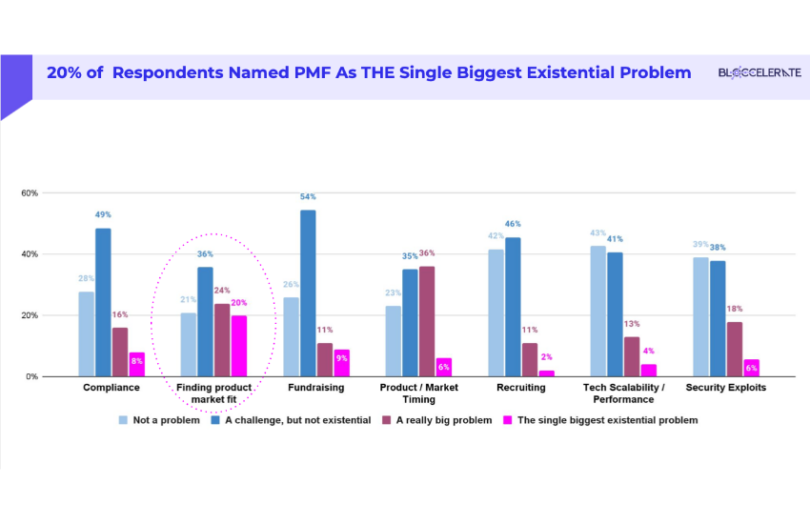

Today venture capital (VC) firm Bloccelerate released the results of its web3 startup survey. With all the talk of funding drying up for blockchain and web3, one of the surprises is that startups don’t consider funding to be the biggest threat. Instead, the most significant challenge is product market fit (PMF).

At first that seemed natural because 46% of survey respondents are at the seed stage. However, when analyzing the responses based on startup maturity, it revealed a surprising result. Series B and later companies were the ones that ranked product market fit as the biggest challenge (29%). That’s counterintuitive because usually the Series A phase is about product market fit (PMF). Series B is meant to be for growth.

One possible explanation is the frothy crypto boom allowed a few companies that hadn’t yet achieved PMF to land a Series B round. It’s also an unfortunate finding because it reinforces the narrative that blockchain and crypto are solutions in search of a problem. Reinforcing this view were survey responses citing a lack of real world use cases outside of DeFi.

Bootstrapped startups don’t fret as much about PMF challenges. That makes sense because one of the reasons some startups don’t see the need for venture capital is that they already have PMF and prefer not to fund externally. Or they might believe the opportunity is too small for a VC.

Web3 funding challenges

There’s another group of bootstrappers who simply haven’t been able to raise funding. That’s probably why no bootstrapped firms considered fundraising an existential threat, but 27% (the largest proportion) considered it a really big problem.

Series B+ startups were the ones most likely to say funding is not a problem (57%). We suspect members of this group are less likely to be the ones struggling with product market fit. The more mature startups are also the ones that find compliance to be the biggest existential challenge.

Market timing

Overall fundraising was only ranked by startups as the third biggest challenge. The second was product / market timing, doubtless largely because of the crypto crash. Outside of the survey, previous research by prolific web2 accelerator IdeaLab found that getting the timing right – not too early but not too late – is the most significant determinant of startup success. More so than the idea, team, and business model.

The Bloccelerate survey involved more than one hundred startups covering most of the world except for Africa and South America.

Meanwhile, Bloccelerate has been around for more than five years. While it has several DeFi and crypto investments it also has a few that are more enterprise and real world focused. For example, its enterprise investments include BlockApps, SettleMint and Hedera. Funding for real world applications includes credit provider Centrifuge, Pontoro for infrastructure loans, and AeroTrax for aircraft part traceability.