BNY Mellon has launched its digital asset custody platform for some U.S. clients, initially supporting bitcoin and ether. It’s a major milestone because BNY Mellon is the world’s largest conventional custodian, with $43 trillion in assets under custody and administration.

“Touching more than 20% of the world’s investable assets, BNY Mellon has the scale to reimagine financial markets through blockchain technology and digital assets,” said Robin Vince, CEO and President at BNY Mellon. “We are excited to help drive the financial industry forward as we begin the next chapter in our innovation journey.”

Last year the bank revealed the creation of a digital assets unit and followed that up by selecting Fireblocks as a technology provider in March alongside a strategic investment. Its new solution also includes technology from blockchain intelligence and risk management firm Chainalysis in which it also invested.

Other crypto investments have included investment manager Valkyrie, trading infrastructure firm Talos, and analytics startup Coin Metrics. It also is involved in numerous permissioned blockchain projects.

In March, BNY Mellon announced plans to be the primary custodian for the USDC stablecoin.

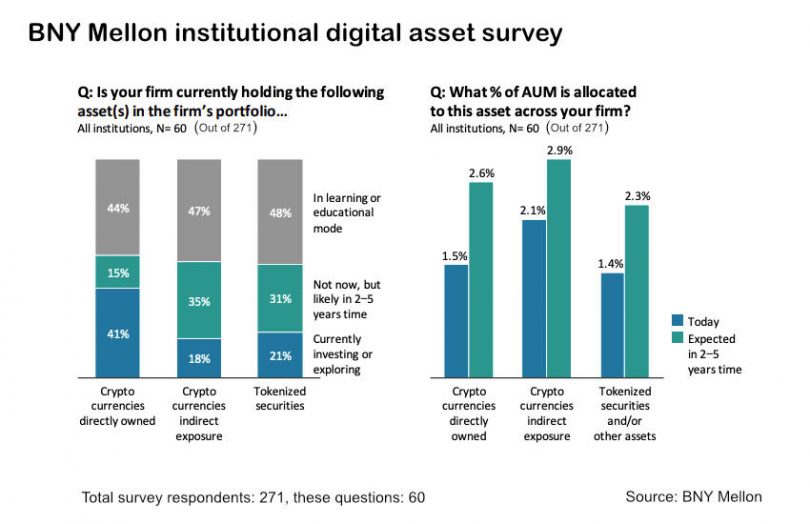

BNY Mellon also released an institutional digital asset survey. It found that 97% agree that “tokenization will revolutionize asset management” and 91% want to invest in tokenized products.

However, right now the majority do not yet own digital assets in the firm’s portfolio. And those that do own them have a small exposure described as ‘exploratory’ levels.

Unlike many other surveys, BNY Mellon’s definition of institutions is a more conventional one and excludes crypto specialists. Despite custody banks being late joiners, more than a third of institutions use them rather than newcomers. 63% want to trade tokenized assets with traditional institutions (TradFi).

A significant proportion of asset managers are taking a short term pause to reassess following the crypto crash. But most of those still expect to move forward soon.

Meanwhile, today the SIX Digital Exchange also announced it had gone live with its crypto custody offering.