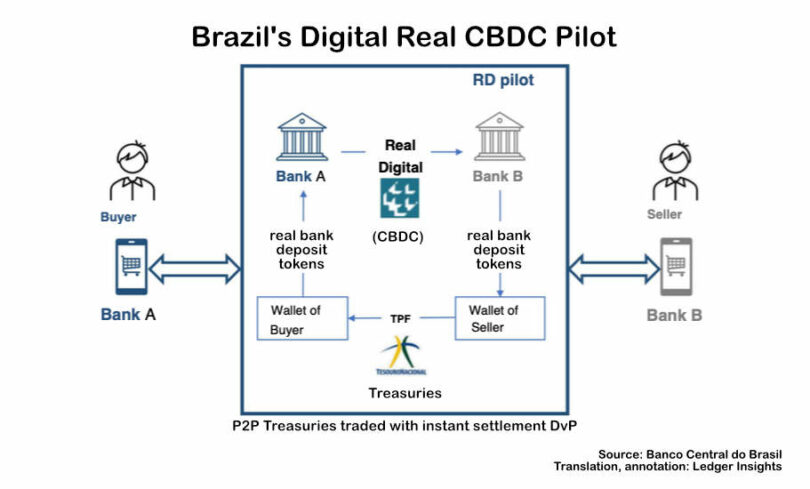

Yesterday afternoon, Banco Central do Brasil announced the formal start of its digital real central bank digital currency (CBDC) pilot, with the final rollout expected by the end of 2024. The CBDC is based on a distributed ledger technology (DLT) designed to settle wholesale interbank transactions. However, retail access will be enabled through tokenized bank deposits. The central bank also said the Treasury is contemplating issuing tokenized government bonds.

Pilot transactions will target instant settlements to ensure delivery versus payment (DvP) of financial assets with some programmability. Crucially, this will allow transactions between banks using the CBDC with instant settlement at the end customer level using deposit tokens. The central bank also wants to test the privacy of these transactions. Rather than real transactions, initially the pilot will involve simulations.

One of the main reasons for not targeting mainstream retail payments is the success of Brazil’s “Pix”, an instant payment method that allows individuals and organizations to transfer and receive money, make purchases, and pay bills.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.