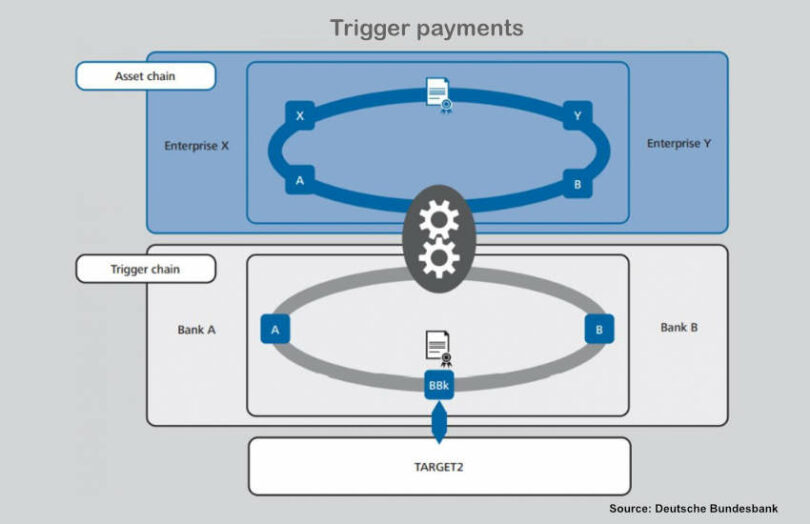

It’s been two years since the Deutsche Bundesbank unveiled tests for a trigger solution to settle DLT securities transactions with central bank money. This links the securities DLT to Europe’s TARGET2 real-time gross settlement system (RTGS) and is viewed as an alternative to a wholesale central bank digital currency (wholesale CBDC).

This month two Bundesbank payments executives outlined why the central bank considers a trigger solution as a wholesale CBDC, even though many expect a wholesale CBDC to be an on-ledger token. Benoît Cœuré, when he was leader of the BIS Innovation Hub, stated that blockchain tokens were the distinctive feature of wholesale CBDC.

In a SUERF policy note, Martin Diehl and Constantin Drott argue that the distinguishing aspect of a wholesale CBDC is its programmability rather than tokenization. The other key features are its restricted access and non cash central bank money, but these two apply equally to conventional wholesale central bank money.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.