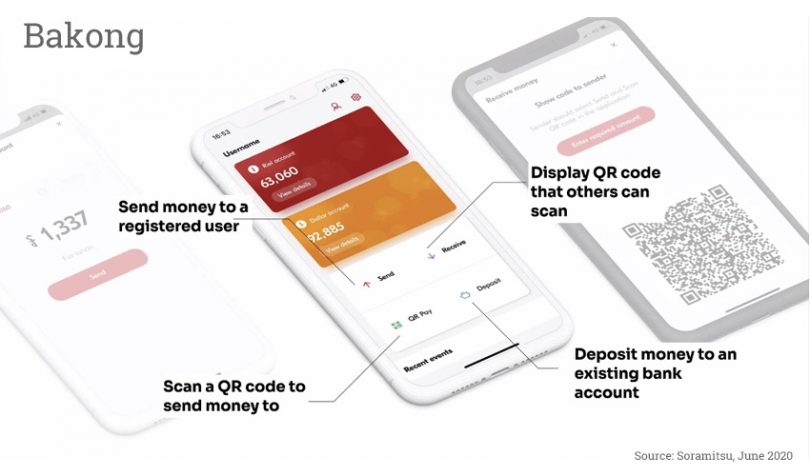

Yesterday, the National Bank of Cambodia’s Bakong blockchain payment system officially went into production after an extensive pilot period. The central bank refers to it as a retail central bank digital currency (CBDC). Unlike other CBDC trials, the currency is not natively digital. Instead, it represents tokenized commercial bank deposits of either Cambodian riel or US dollars.

A major reason for launching Bakong is financial inclusion. Cambodia has a high rate of smartphone penetration and more than 100% of the population has a cellphone, clearly some more than one. However, only 22% of people over the age of 15 have a bank account, and an account is not required to use Bakong. Instead, a wallet can be started by receiving money from someone else or by going to a payment agent and exchanging cash for tokenized money.

“We aim to improve financial inclusion, efficiency and security, as well as promote the use of local currencies,” said Serey Chea, Director General at the NBC. “Bakong is Cambodia. It plays a central role in placing all players who use their payments under the same platform, making it easier for users to cross the boundaries between banks and pay each other.”

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.