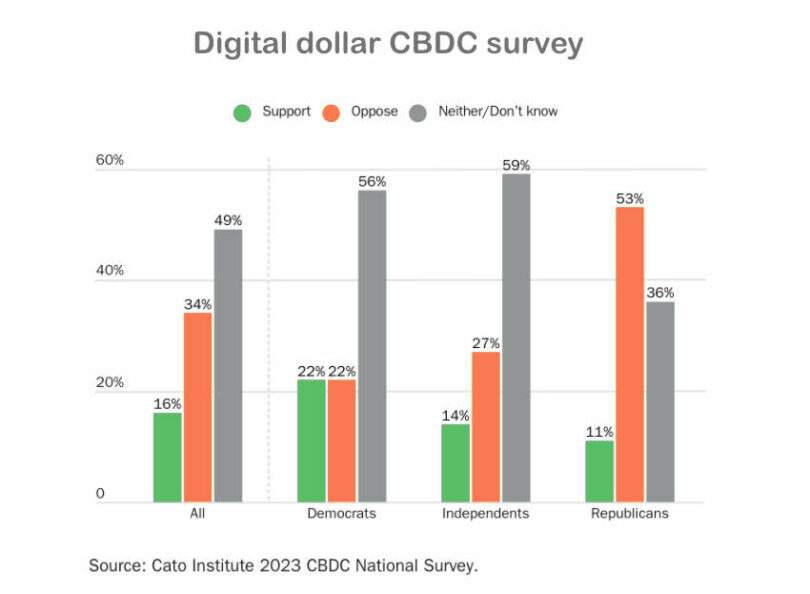

A recent poll by YouGov and the Cato Institute found that 34% of Americans oppose the issuance of a central bank digital currency (CBDC), compared to 16% who favor it. Fears of government control, elimination of cash, and cyberattacks continue to weigh on people’s views of a digital dollar, especially among U.S. Republicans. Trust in the Federal Reserve (Fed) and familiarity with CBDCs were the most heavily correlated with support.

The survey found that twice as many Americans oppose the idea of a federally controlled digital dollar as those who support it. However, most people (49%) have yet to form an opinion, probably due to the population’s general lack of knowledge of CBDCs.

Among those who opposed a digital dollar, the most compelling reasons were associated with familiar concerns of government monitoring and control, as well as with fears over the future of cash and the risks of attracting potential cyberattacks. For example, 68% of Americans would oppose a CBDC if it meant the government could see what they spend their money on, as would 68% if it led to the abolishment of cash.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.