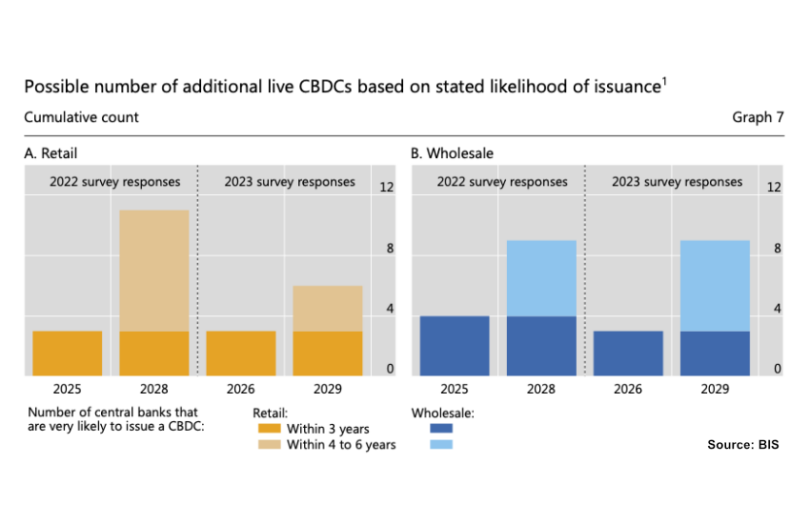

Today the BIS released its latest central bank digital currency (CBDC) survey, with the number of central banks exploring the topic increasing from 93% in 2022 to 94% in 2023. Compared to the previous year, the expectations for retail CBDC issuances in the medium term (4-6 years) have declined sharply. By 2029 there are now likely to be six new issuances, down from 11 anticipated last year. In contrast, the outlook for wholesale CBDC has remained constant with nine new wholesale CBDCs expected by 2029. Additionally, there’s been a sharp increase in the number of wholesale CBDC pilots launched during the past year.

For example, we’ve reported on Europe’s wholesale DLT settlement trials and new initiatives from the Philippines, Switzerland, South Africa, Singapore, Hong Kong and Korea. The survey showed that the timescale for expected wholesale issuances had extended a little.

While the motivations of advanced economies and emerging markets are quite different, there has been some convergence. Domestic payment efficiencies scored as the top motivation for retail CBDCs for both types of economy with a matching score. Likewise for wholesale CBDC’s the top driver is cross border payment efficiency with very similar scores for each type of economy.

Regarding the top priority functionality for retail payments (in order) they are:

- Interoperability with domestic payment systems

- Limits on balances

- Offline payments

- Programmable payments

And for wholesale CBDC:

- Interoperability with domestic payment systems

- Programmable payments

- Programmable money

- Interoperability with other CBDCs

Regarding wholesale use cases, 46% anticipate usage for interbank payments and 50% for delivery versus payment.

Mainstream stablecoin usage is still niche, but …

The survey also explored the usage of stablecoins, finding continued limited use for mainstream payments. A breakdown between domestic and cross border usage showed a reasonable level of niche usage cross border. Remittances are the top application, and at least one respondent found the wider public is using stablecoins for cross-border business usage.

According to the research, two out of three jurisdictions will soon regulate crypto-assets.