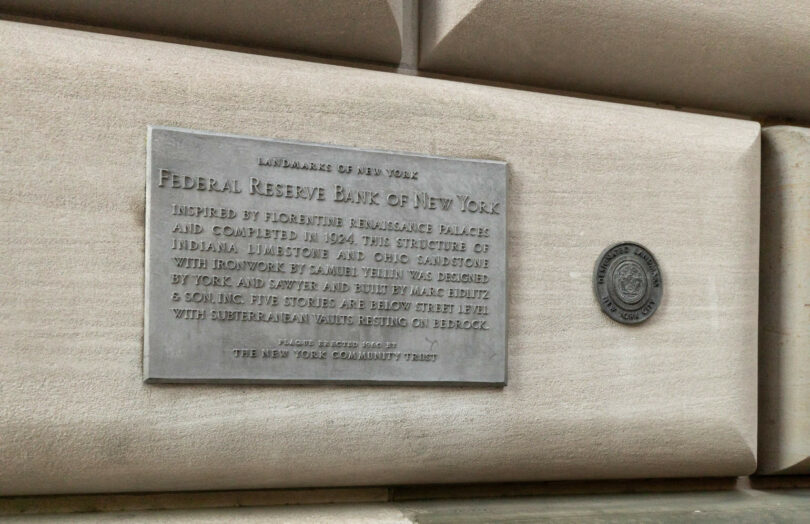

Imagine a financial world where every transaction, from billion-dollar treasury purchases to retail payments, exists entirely as digital tokens. The Federal Reserve Bank of New York and the Bank for International Settlements Innovation Hub aren’t just imagining this scenario, they’re actively preparing for it through Project Pine.

The New York Innovation Center (NYIC), part of the Federal Reserve Bank of New York, ran this groundbreaking initiative jointly with the BIS Innovation Hub. Together, they’ve developed a toolkit of smart contracts designed to execute monetary policy in a fully tokenized financial system. The toolkit aims to fulfill traditional central bank functions – paying interest on reserves, conducting open market operations, managing collateral, and supporting credit and asset purchases – all adapted for a tokenized environment.

Six additional central banks contributed requirements for the project, emphasizing flexibility as their paramount concern. This focus on adaptability yielded an unexpected benefit: the potential for dramatically faster crisis response.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.