Whether or not the Chinese renminbi (RMB) can challenge the dollar’s dominance is a matter of ongoing debate, including the role of China’s future central bank digital currency DC/EP. On Tuesday, the second largest firm in the world, state-owned China Construction Bank (CCB) published the “2020 RMB Internationalization Report” in conjunction with the Asian Banker.

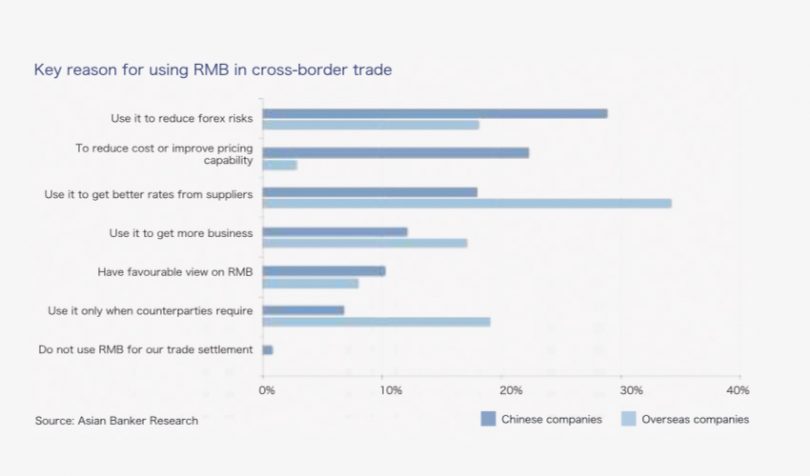

Based on a 2019 survey of 643 corporates and financial institutions, the CCB claims that 67% of overseas corporate respondents increased their use of the renminbi for cross border trade. The most common reason was to get better rates from suppliers (34%). Just 19% responded that the RMB motivation was because their trading partner required it, down from 47% in 2017.

Even if companies use the RMB for trade, that doesn’t mean it’s for every transaction. 76% of the overseas companies said more than 10% of their trade was in RMB.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.