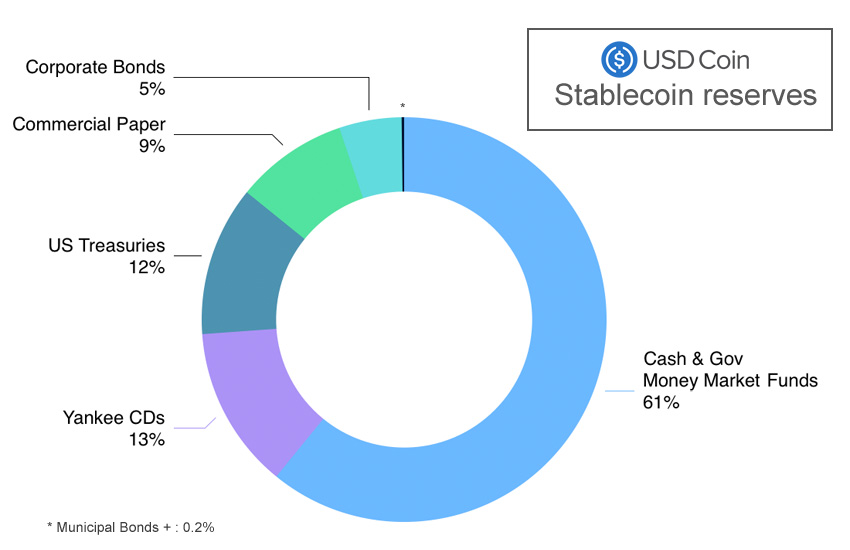

Yesterday, Circle the administrator of the USDC stablecoin (market cap $27 billion), shared details about the assets that underpin the digital currency as the company prepares to list via a SPAC. The degree of transparency and quality of assets is significantly superior compared to the Tether stablecoin (market cap $62 billion), where the asset backing raised concerns at the Boston Federal Reserve and Fitch. But there have always been significant questions around Tether.

In a crisis, there’s a strong chance that Circle would be able to meet significant USDC redemptions, if not instantly, then within a pretty short timeframe. Putting it another way, if regulators bring in rules about the quality of assets that need to back stablecoins, it’s likely that USDC assets would easily comply. And that can’t be said for Tether by a wide margin.

When the Boston Fed voiced concerns about stablecoins, it compared them to money market funds that have required interventions during the last two crises. While Circle holds 61% of funds in cash and government money market funds, these are not the sort of money market funds that have caused issues. For example, during the March 2020 money market liquidity crisis, prime money market funds experienced mass redemptions and these are not invested in treasuries.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.