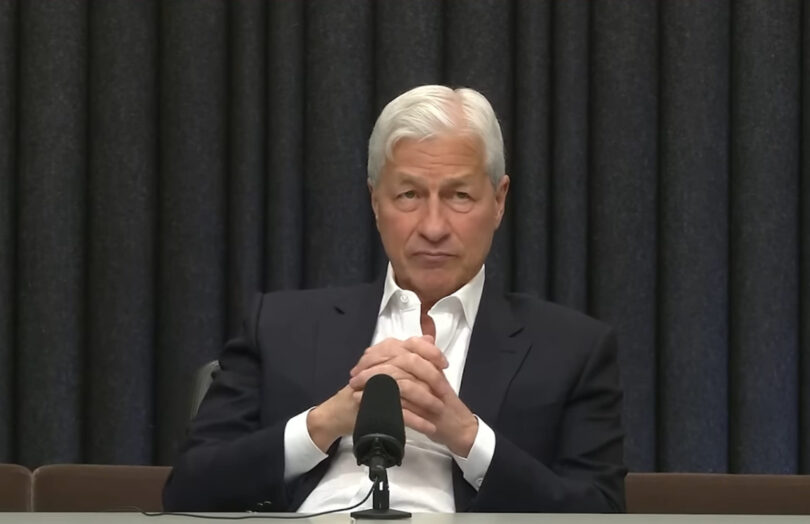

Both Citi and JP Morgan held 2025 Q2 earnings calls yesterday, and the topic of stablecoins and tokenized deposits was raised. Citi CEO Jane Fraser outlined the bank’s areas of interest, including issuing one. JP Morgan CEO Jamie Dimon sounded somewhat skeptical about stablecoins, but given the customer interest, the bank plans to be ‘a player’.

Tokenized deposits refer to digital twin tokens that mirror a bank account, whereas deposit tokens are usually natively issued on the blockchain, often on public chains.

Last month JP Morgan announced plans to pilot a deposit token, JPMD, on a public blockchain. It intends to make it available to its own clients as well as the clients of the financial services firms that it serves. For several years the bank has offered a permissioned blockchain-based bank account – Kinexys Digital Payments (formerly JPM Coin and Onyx) – that processes roughly $2 billion in transactions daily. A key appeal is 24/7 instant cross border money movement between JP Morgan branches.

When asked about stablecoins and deposit tokens, Dimon responded, “So a deposit token is effectively the same thing. You’re moving money by token, you can pay interest.”

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.