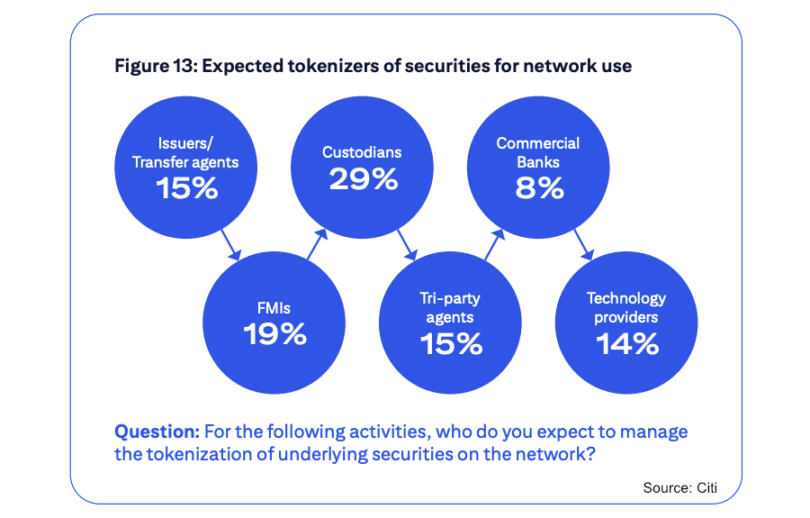

Citi Securities Services published its latest Evolution whitepaper based on a survey of 537 market participants. The poll revealed that respondents expect 10% of trading volume to be tokenized by 2030, with custodians as the most prominent tokenization enabler.

The rationale is that 63% of institutions expect to be operating using multiple blockchains by 2030, and they view custodians as enabling that connectivity. However, this preference may shift over time.

Citi has conducted this survey annually for several years, revealing significant shifts in opinion, particularly regarding digital asset classes. Last year, when asked about which digital asset class would grow the fastest by 2030, tokenized private / alternative assets and cryptocurrencies made up almost 60% of the responses.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.