Yesterday Citi Securities Services released the results of its latest survey finding that almost three quarters (74%) of institutions are currently actively engaged in digital assets or DLT, up from 47% last year.

One of the biggest changes since 2022 is the rising expectations around regulated digital money. Perhaps that’s not surprising given the uptick in discussions about bank deposit tokens and stablecoins.

Last year 28% said digital currency would not be available for settlement by 2026, whereas now only 13% believe that. Just over half expect central bank digital currencies (CBDC) to be in use by then, up three percent from last year. But the biggest shift related to bank issued digital money, with 27% of institutions now expecting that to be available in three years, compared to just 17% in 2022.

Unrelated to DLT, in the core part of the Citi survey regarding settlement times, few expect to see broad adoption of atomic settlement for equities any time soon. Just over a quarter predict it will be the norm in 15 years.

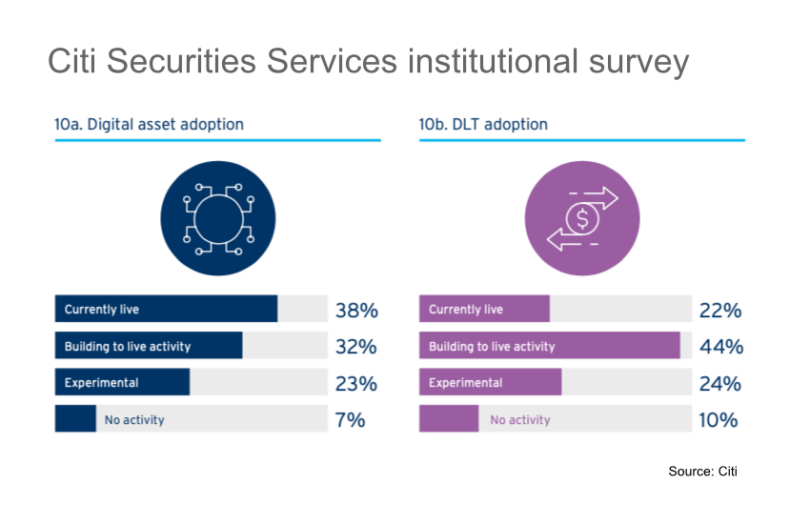

In terms of live deployments, far more institutions are in production with digital assets (crypto) (38%) compared to DLT and tokens (22%). However, the order is the other way around for organizations building towards production, with a higher proportion targeting DLT and token (44%) solutions compared to crypto (32%). The crypto fallout likely played a role in these priorities.

Diverse views of different types of institutions

Amongst different types of institutions, custodians (87%) are the most engaged in DLT and digital assets, with the laggards being asset managers (60%) and institutional investors (25%).

The survey threw up a mismatch in tokenization expectations between the different groups. For example, the sell side see tokenization benefits for listed equities and public debt. In contrast, institutional investors are interested in the tokenization of private equities and debt, hoping to see liquidity improvements.

Several challenges remain to widespread institutional adoption of DLT. The survey found that the top two are regularity uncertainty and internal risk and compliance engagement.

Meanwhile, SIX recently surveyed asset managers, wealth managers and hedge funds. It found only 11% had already invested in digital tokens (not crypto or stablecoins), whereas 69% plan to by April next year.