Digital currency threatens to squeeze bank payment activity. But banks in some countries, Germany in particular, are looking to carve out B2B payments as their segment for bank deposit tokens. The plan is to mint the commercial bank money tokens directly onto private and public DLT networks instead of the bank’s own network.

In Europe, the ECB has prioritized its digital euro central bank digital currency (CBDC) use cases, with consumer payments receiving the focus and little mention of B2B payments. Hence, it leaves this opportunity wide open to commercial banks.

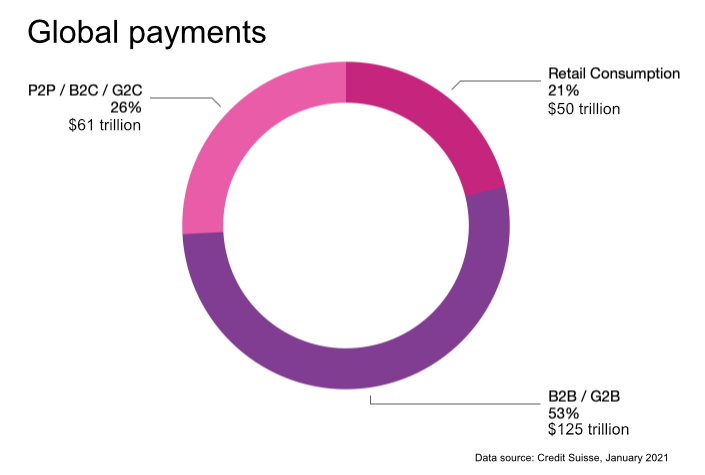

To counter the perception that banks are being squeezed, it’s worth highlighting that B2B is the largest payments segment globally. In 2018 Goldman Sachs estimate B2B payments at $127 trillion. More recently, Credit Suisse pegged B2B payments at $125 trillion out of a $235 trillion total market.

Deposit tokens issued on business DLT networks

At the Digital Euro Conference last Friday, Claus George of Germany’s DZBank revealed it is conducting a proof of concept alongside other banks with four corporate clients by issuing deposit tokens directly onto private DLT networks. He sees this as enabling corporates to do business more efficiently.

“It is the most convenient form (of money) if you have it as a native asset on your DLT where you do your basic business process, and you can access your money in the same way that you manage your business processes,” said George. “You don’t have this separation that you have today between payments and business processes.”

To date, the highest profile blockchain-based bank money has been JP Morgan’s JPM Coin. Whereas the tokens from the various German banks are issued on third party DLT networks enabling payments between clients of different banks, JPM Coins work on the bank’s own blockchain, purely between JP Morgan clients. This is the contrast between deposit tokens versus blockchain-based bank accounts.

Earlier this year, JP Morgan and Oliver Wyman published a report on deposit tokens that seek to work beyond the bank’s own blockchain network. Apart from co-founding Partior for interbank multicurrency payments, JP Morgan has been part of Singapore’s Project Guardian, which involved issuing deposit tokens onto a public blockchain.

Germany’s work on commercial bank money tokens

But work has been afoot in Germany for some time. During 2021, the major German banking associations collaborated on a digital money paper highlighting potential paths for deposit tokens or commercial bank money tokens (CBMT).

Those options are:

- Each bank issues standardized stablecoins backed by ring-fenced reserves at the ECB

- A joint stablecoin or synthetic CBDC where the banks create a special purpose vehicle (similar to Fnality)

- Commercial bank money tokens or so-called colored coins represent bank deposits with interoperability.

The German banking community prefers the third option, with interoperability enabled through an interbank settlement network- a sort of real time gross settlement (RTGS) system for bank tokens. However, some net settlement is on the cards as well.

One approach to interoperability for bank deposit tokens

In late 2022 the banking associations published another paper highlighting how such a network might work. Imagine a car manufacturer’s supply chain blockchain for processing and fulfilling orders. Its suppliers use seven different banks. But in this example the car manufacturer only uses one.

Using the blockchain, the auto company issues purchase orders, receives delivery notes, and finally, invoices. Then the manufacturing customer pays the invoices from the supplier using its Bank A token. That supplier has an account at Bank B rather than Bank A. So the tokens in its wallet are automatically converted from Bank A to Bank B tokens. And Bank A and Bank B settle up on the separate interbank network. That’s a simplification, but the gist of how it might work.

However, pulling this off requires a significant amount of collaboration. During the same Digital Euro Conference, the Deutsche Bundesbank’s Dirk Schrade was skeptical. Talking about tokenized deposits, he said, “Interesting developments, but here the proof in the end is in the pudding. I think concepts are nice, but you also have to put something into practice. When we look at the payments industry in the past in Europe, I personally have not seen so much cooperation. And that could be a key point to really see whether this can be a success.”

Other approaches to deposit tokens

There are a variety of approaches to enable interoperability between tokenized bank deposits. As mentioned, the UK’s Fnality opted for a shared settlement token targeting interbank transactions. The Swiss Banking Association recently highlighted three similar approaches to Germany but instead preferred a Fnality-style approach, allowing the token to be used by corporates, not just banks.

Meanwhile, the Regulated Liability Network is an even bigger idea for a shared network on which CBDCs, deposit tokens and possibly regulated stablecoins could coexist. In the U.S. the USDF Consortium is working on an interoperable network for deposit tokens, and TassatPay is creating a network to connect blockchain-based bank accounts. The now-bankrupt Signature Bank was one of the bigger users of TassatPay-powered DLT-based accounts.

While Signature was known as one of the crypto banks, it recently revealed that the volume of blockchain transactions for cargo shipping companies was larger than for crypto firms. That underlines the demand for 24/7 corporate payments and meeting the needs of B2B clients.