At the moment, with the crisis triggered by Covid-19 the markets are focused on survival, which is masking the impact of increased dollar dominance and its adverse effects.

In good times, if large parts of the world denominate transactions in dollars, it’s extremely convenient. But in a crisis, this over-reliance can be a problem because there may not be enough dollars to go around. Although central banks can help with liquidity in their local currencies, in some jurisdictions, it’s a bigger challenge to help businesses with dollars, as highlighted by two Credit Suisse research reports.

The first problem is liquidity, but the second related issue is the significant foreign exchange risk. In a crisis like the current one, the dollar is getting stronger across the board. In the last two weeks, the U.S. dollar has strengthened by 5.3% against the Euro, 5.9% versus the Swiss Franc, 7.7% against the Japanese Yen and a whopping 13.9% versus the British Pound.

So for any non-U.S. corporate with dollar-denominated debt, it now has to repay that much more in local currency equivalent. That’s in addition to any dramatic drop in revenues as a result of the crisis.

A third issue is the many adverse side effects of a strengthening dollar. A BIS paper published last week shows that a stronger dollar negatively impacts emerging market economic activity as well as international trade. And that’s without Covid-19.

Today IMF Managing Director Kristalina Georgieva said: “Investors have already removed US$83 billion from emerging markets since the beginning of the crisis, the largest capital outflow ever recorded.”

So what’s the alternative to dollar dominance? One is to increase usage of another currency such as the Renminbi. But two competing currencies can also cause issues, especially in a crisis.

Last year, the Bank of England Governor Mark Carney spoke about a new kind of global currency, which could be a basket of digital currencies. A little like Facebook’s Libra, but instead a basket of central bank digital currencies. How much would this help or hinder in a situation like the current one?

An increased dollar dominance, and shift away from bank lending

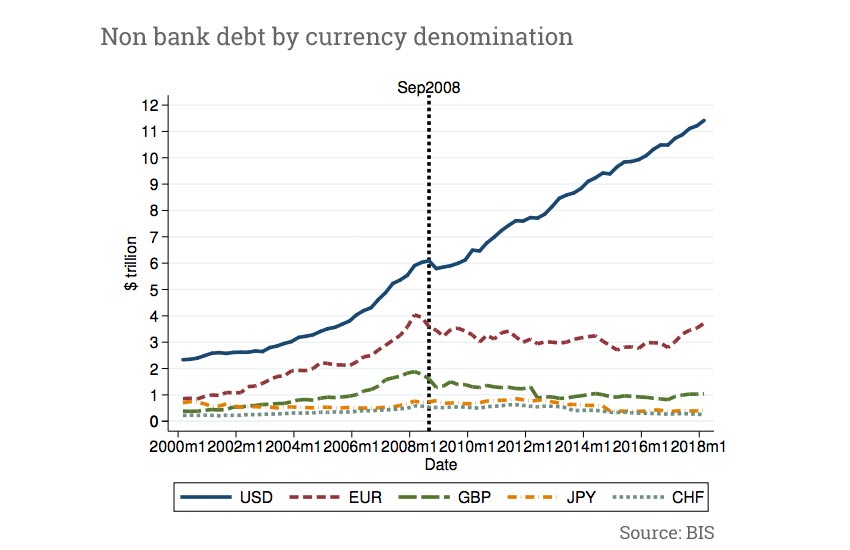

Since the 2008 crisis, the dominance of the U.S. Dollar in international trade has increased. Additionally, the rising dollar usage extends to debt.

The increase in dollar corporate debt is in part because of a greater reliance on financial markets as opposed to banks. Last week the BIS published a report showing this shift to market-based leverage. Basel III rules have meant that banks had to beef up their balance sheets so they could handle more shocks like the current one. That means the bank proportion of lending has declined.

That reduced reliance on banks is also why the U.S. Federal Reserve stepped in to support corporate debt because a larger slice of it is now in the bond markets.

Local banks tend to lend in domestic currencies. International markets bias to dollars.

Another BIS report argues that the dollar’s dominance is the result of the debt currency choice of firms, which in turn is based on the risk properties of the dollar compared to other currencies.

Stalling revenues create a gulf

Meanwhile, the Coronavirus Crisis has triggered a sudden drop in production and sales. That means a lower inflow of dollars to foreign countries from income, and those dollars are needed to service interest payments on dollar-denominated debts.

Credit Suisse notes that while emerging markets may have plenty of foreign exchange reserves, most of this is invested in the FX swap markets. When the central banks withdraw from the swap markets and use the dollars domestically to help local banks and corporates, that could have a significant impact on the liquidity of the FX swap markets.

In addition to Basel III rules, as a result of the 2008 crisis and the stress points, the Fed has dollar swap lines with the central banks of Europe, Switzerland, England, China and Japan. But the Covid-19 crisis is global. In recent research, Credit Suisse stated: “We are more worried about other jurisdictions.”

To that point, in today’s statement, the IMF’s Georgieva said: “Major central banks have initiated bilateral swap lines with emerging market countries. As a global liquidity crunch takes hold, we need members to provide additional swap lines.”

As an aside, while Basel III means that banks have buffers of High Quality Liquid Assets (HQLA), not all jurisdictions enforced currency matching of HQLA portfolios with outflows, adding more currency risk.

Would a basket be better than the dollar?

On the one hand, the concept of a basket-based digital currency or “Synthetic Hegemonic Currency” (SHC) seems appealing. It would reduce the political risks of depending on the U.S. dollar as well as economic risks purely associated with America. A basket should be more stable than a single currency.

But would CBDC help in a crisis like the current one?

First off is the oft-quoted concerns of central bankers that a digital currency would encourage a flight to central bank digital currencies during a crisis. That could exaggerate liquidity issues for banks.

But most of all, it depends on whether the basket is intended to replace the local currency. Assuming it is not, then all the challenges remain.

The basket would still be a foreign currency, so there could be liquidity issues at a domestic level if trade and corporate debt is widely denominated in the basket. There would still be foreign exchange risks. These could be amplified it is easy to switch from a local (weaker) CBDC to the basket CBDC. And the strengthening of the basket versus other currencies could also have negative impacts on activity and trade.

The assumption is the basket currency is not intended to replace a local currency. But if it were, that is potentially worse. The Euro has highlighted the significant challenges of sharing a common currency between vastly different national economies. Right now, the U.K. is patting itself on the back about the flexibility enabled by Brexit.

The reality is the Corona Crisis is one of the biggest crises the world has faced since World War II. CBDC’s might help to implement policies quicker. But chaos is not something that can be easily controlled.

Today the IMF predicted that this year’s recession would be steeper than the Global Financial Crisis. If Morgan Stanley’s estimate of a 30% plunge in Q2 GDP in the U.S. is vaguely on target, the IMF’s statement might be an understatement. But the IMF’s Georgieva concluded on the appropriate note:

“Let us stand together through this emergency to support all people across the world.”