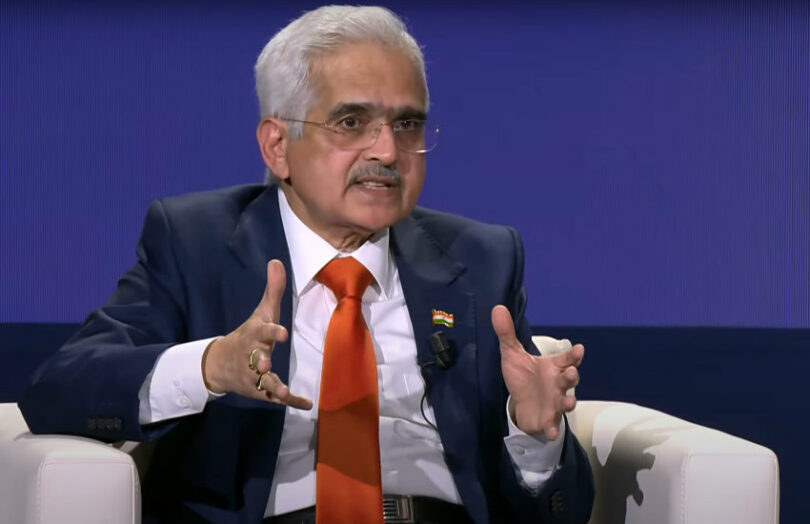

Reserve Bank of India Governor Shaktikanta Das recently discussed India’s progress with central bank digital currency (CBDC). After almost a year of wholesale and retail CBDC pilots, he is even more convinced about the role of a digital rupee for cross border transactions. He also sees CBDCs as countering the attraction of stablecoins. Governor Das spoke during the World Bank Group – IMF Annual Meetings this month.

CBDC as a foil to stablecoins

“On stablecoins – the fundamental question that begs an answer is whether the governments and central banks are comfortable with private currency. Currency is a sovereign function which the sovereign delegates to the central bank in a country like India. So therefore, are we comfortable with private currency? So these new technology products which are coming and styling themselves as great innovations, there are financial consequences,” said Governor Das.

He continued, “On such matters, whether it is stablecoins or cryptocurrencies or whatever you call it, I think we need to fully understand the risks before trying to legitimize them. We (need to) know before entering the water, how many sharks are there inside the water. Therefore CBDC is important. The world is moving towards technology.”

Digital rupee pilots

The central banker recounted how India initiated its CBDC pilots almost a year ago. It started with wholesale CBDC in November 2022 using it for secondary market settlement of government bonds. More recently, it progressed to overnight money markets.

In December 2022 India commenced its retail CBDC trials. Millions of customers are now enrolled and almost every Indian bank. Governor Das spoke about the simplicity of using the digital rupee, with many fruit and vegetable vendors now enrolled to accept the CBDC. The digital currency also shares QR codes for payment with UPI, India’s instant payment system. The Governor said the learnings from the CBDC pilot “have been excellent.”

Recently, an executive from India’s Treasury acknowledged the challenge of retail CBDC adoption given the success of UPI. Monthly transactions on UPI recently passed ten billion.

CBDC for cross border payments

However, the first CBDC point made by Governor Das was about cross border payments and he quickly returned to the topic. Following the pilots, “We are even more convinced that CBDC can be the most effective and efficient mode for cross border payments in particular, other than of course domestic transactions,” said the Governor.

He bemoaned the global average remittance cost of 6% and believes CBDC can help to reduce that.

“And on this, we are also in active discussion with other countries which are carrying out similar efforts,” he said.

In March India and the UAE announced joint trials targeting remittances and trade. More than 3.5 million Indians work in the Emirates and it’s the second largest source of Indian remittances. Meanwhile, the UAE also recently signed a digital currency deal with China, separate from their joint work on the mBridge cross border CBDC project.