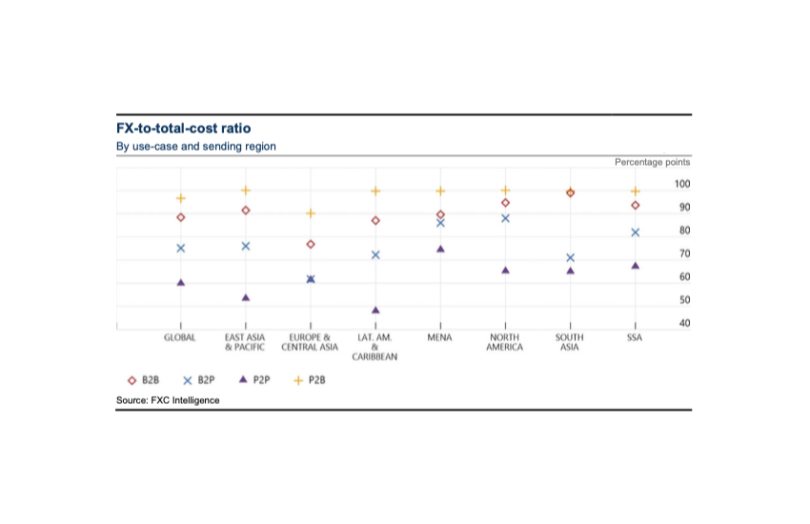

As part of the G20 program to enhance cross border payments, today the Financial Stability Board (FSB) released a first set of measurements of the current status. The objective is to compare these to target metrics (KPIs). The cost of foreign exchange (FX) was the standout finding, measuring 60% of P2P payments globally and as high as 97% of P2B payments.

This figure alone could encourage central banks to become more involved in cross border payments, reinforcing their role in cross border CBDC initiatives. Some of those CBDC programs have explored providers competing for FX.

That said, the figures likely overstate the FX proportion. The FSB report noted it is hard to tell how much of the amount truly relates to FX. For example, some organizations offer “zero fee” transfers but compensate themselves with a higher FX charge. Others might charge a percentage fee and zero FX charges.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.