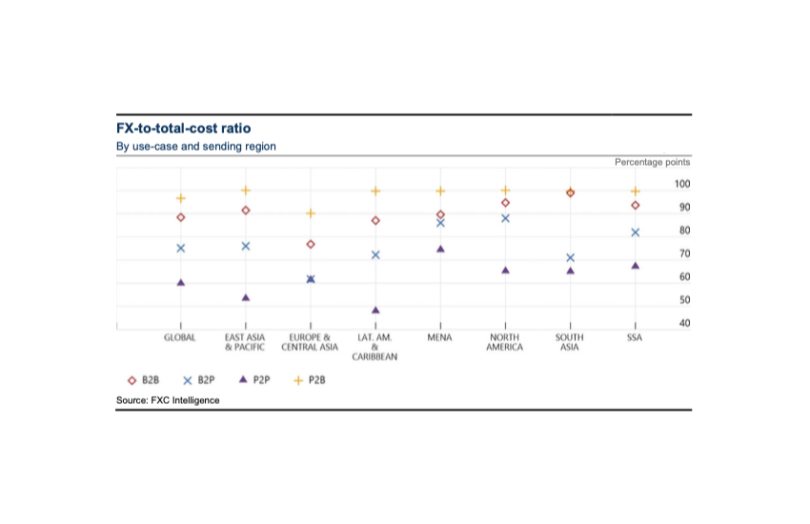

As part of the G20 program to enhance cross border payments, today the Financial Stability Board (FSB) released a first set of measurements of the current status. The objective is to compare these to target metrics (KPIs). The cost of foreign exchange (FX) was the standout finding, measuring 60% of P2P payments globally and as high as 97% of P2B payments.

This figure alone could encourage central banks to become more involved in cross border payments, reinforcing their role in cross border CBDC initiatives. Some of those CBDC programs have explored providers competing for FX.

That said, the figures likely overstate the FX proportion. The FSB report noted it is hard to tell how much of the amount truly relates to FX. For example, some organizations offer “zero fee” transfers but compensate themselves with a higher FX charge. Others might charge a percentage fee and zero FX charges.

54% of wholesale payments credited in one hour. Swift not at fault

People often blame Swift for slow cross border payments, but the organization has been telling people for years that the vast majority of payments are very fast. In fact, 89% of its transfers arrive at the recipient bank within one hour, rising to 99% in one day.

However, a high proportion of payments are stalled at the recipient bank. Only 54% of the transfers are credited to the customer’s account in one hour, and 93% within a day. The G20 targets are 75% and 100% respectively.

Swift attributes the bank delays to:

- operating hours – payments arrive when banks are closed

- batch processing

- time zone impact – “following the sun” payments are faster

- currency and capital controls

However, banks say AML compliance is a major factor

Remittance targets are lagging

The G20 target for the cost of remittances – retail transfers of under $200 – is 3% or less. The headline rate is currently 6.3%, and an alternative “SmaRT measure” is 3.5%, which is still above the target.

The World Bank has been providing figures on remittances for years. At a practical level, it finds out what money transfer firms charge for different types of payments. And it tends to do a simple average of these charges, arriving at the headline rate. Some offers are very expensive, and might not be used very often. In other words, the figures do not represent any weighting according to what’s popular.

One has to assume that cheaper rates are more popular. Hence, there’s another target, the World Bank’s Smart Remitter Target (SmaRT), taking an average of the three cheapest rates. This is the one that comes in at an average cost of 3.5%.

In our view, these measures are still best estimates. Remittance costs are far more expensive if cash is involved at either end of the payment. So while the SmaRT measurement is a great idea, those without access to a bank account or digital means of payment will pay substantially more.

There are also significant variations in costs between regions. Payments made from Latin America and the Caribbean or Sub-Saharan Africa cost significantly more than other jurisdictions.

Overall, the report is packed with useful data on payments and is well worth reading.