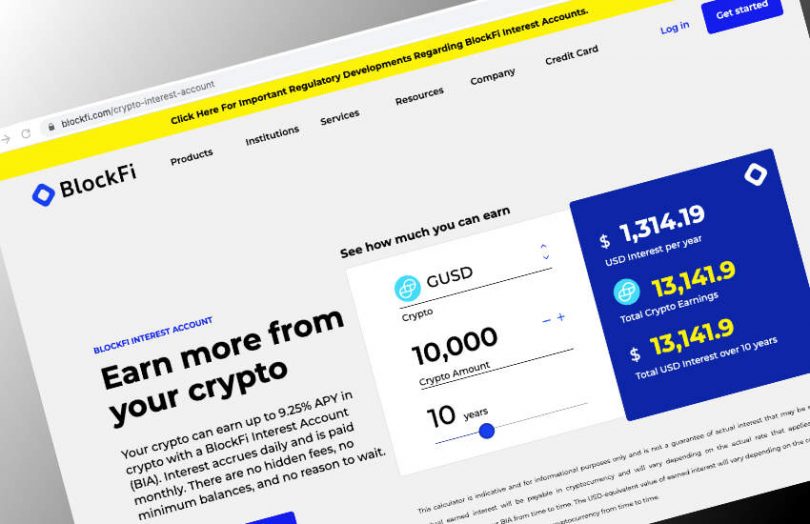

Today the Securities and Exchange Commission (SEC) announced it had charged BlockFi Lending with securities breaches relating to its cryptocurrency lending activities. The startup agreed to pay a penalty of $50 million to the SEC and another $50 million to 32 state regulators. However, BlockFi intends to register with the SEC for a new “BlockFi Yield” offering, a regulated security.

Talking about the new “BlockFi Yield” plans, the founders said, “With today’s resolution, we are leading the creation of a new regulatory landscape for crypto and our clients.”

Since Gary Gensler took office as Chair at the SEC, he has argued that crypto lending services are securities. Last year, when cryptocurrency exchange Coinbase revealed plans for its cryptocurrency lending product, the SEC apparently stated that crypto lending is an unregulated security and Coinbase did not proceed.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.