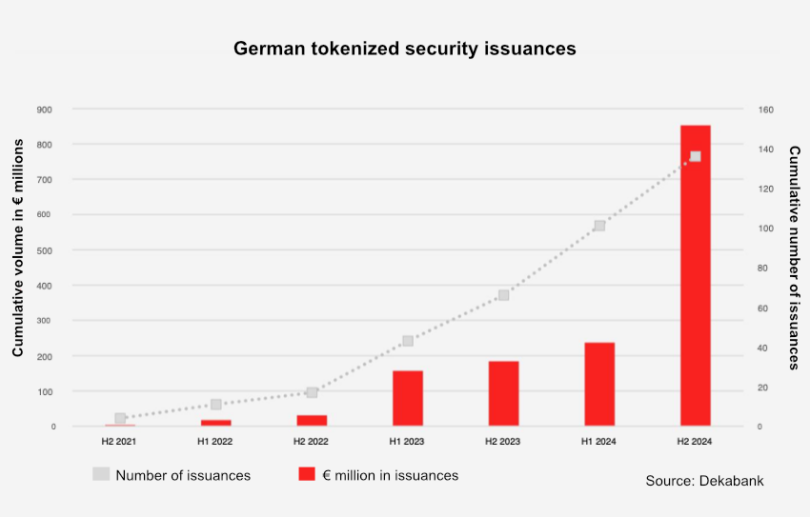

The Eurosystem’s DLT settlement trails in central bank money were a massive boost to German tokenization issuances. Across all jurisdictions the total amount of transactions was €1.59 billion. German digital securities issuances in the second half of 2024 totaled €615 million, compared to a total of €235 million cumulatively in up until then. That’s according to the latest Deka Digital Asset Monitor.

The first issuances under Germany’s Electronic Securities Act (eWpG) were in the second half of 2021. The law distinguishes between crypto securities which are more decentralized, versus those issued via a central securities depository (CSD). Hence, the €8.5 billion in digital bonds issued by KfW in 2024 via the centralized version of Clearstream’s D7 are not crypto securities and excluded from the above figures.

While the Euro value of issuances shot up, the number of issuances did not – it was 35 in both H1 and H2. The big difference is the first half of the year was dominated by smaller SME issuances, whereas there were more institutions and large issuances in the second half, including the €300 million Siemens digital bond and a €100 million issuance from Berlin Hyp with two issuances totaling €150m from KfW.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.